By FXEmpire.com

Crude Oil Fundamental Analysis April 3, 2012, Forecast

Analysis and Recommendations:

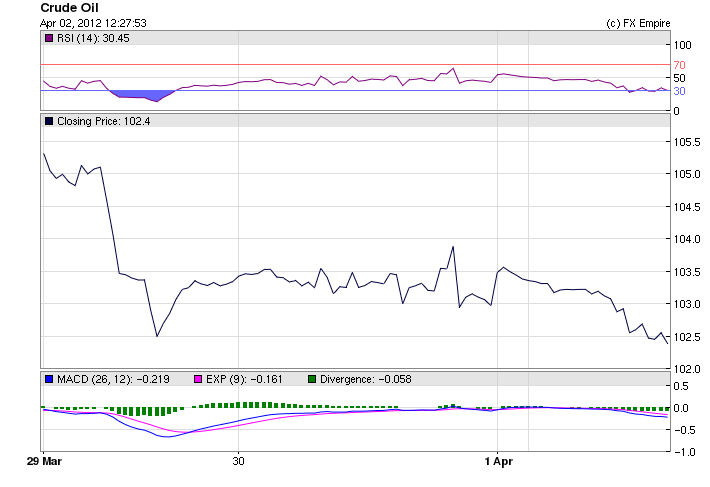

Crude Oil is trading at 104.67 up from 103.31 and several economic reports and on geopolitical rumors from southern Iraq. News came forward today that there is a possible supply disruption from the Kurdish territory in Iraq. There has been no supporting information at this time.

Also, China’s manufacturing got a mixed assessment on Sunday, as the official survey for March improved to its highest in a year and a competing survey by HSBC showed the sector moving deeper into contraction.

Key Points from the Report reflect

A. Reduced factory output reflects falling new business from home and abroad

B. Manufacturing employment down at sharpest rate in three years

C. Input price inflation ticks higher, but remains modest overall

Economic research indicates that measures of global output may be behind the recent strength in U.S. inflation, said James Bullard, the president of the St. Louis Federal Reserve Bank. Bullard made the remarks in a speech.

A gauge that measures the strength of the manufacturing sector, produced by the Institute for Supply Management, rose to 53.4% last month from 52.4% in February. Reading over 50% indicates that more manufacturers are expanding than contracting.

Economic research indicates that measures of global output may be behind the recent strength in U.S. inflation, said James Bullard, the president of the St. Louis Federal Reserve Bank. Bullard made the remarks in a speech.

A gauge that measures the strength of the manufacturing sector, produced by the Institute for Supply Management, rose to 53.4% last month from 52.4% in February. Reading over 50% indicates that more manufacturers are expanding than contracting.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule)

Economic Data for April 2, 2012 actual v. forecast

|

00:00 |

KRW |

South Korean CPI (YoY) |

2.6% |

3.1% |

3.1% |

|

00:50 |

JPY |

Tankan Large Manufacturers Index |

-4 |

-1 |

-4 |

|

02:30 |

AUD |

Building Approvals (MoM) |

-7.8% |

0.3% |

1.1% |

|

06:05 |

INR |

Indian Trade Balance |

-15.2B |

-13.0B |

-14.8B |

|

08:00 |

DKK |

Danish Retail Sales (YoY) |

-0.5% |

-1.7% |

-3.3% |

|

08:15 |

CHF |

Retail Sales (YoY) |

0.8% |

3.2% |

4.7% |

|

08:30 |

CHF |

SVME PMI |

51.1 |

49.5 |

49.0 |

|

08:50 |

EUR |

French Manufacturing PMI |

46.7 |

47.6 |

47.6 |

|

08:55 |

EUR |

German Manufacturing PMI |

48.4 |

48.1 |

48.1 |

|

09:00 |

EUR |

Manufacturing PMI |

47.7 |

47.7 |

47.7 |

|

09:30 |

GBP |

Manufacturing PMI |

52.1 |

50.5 |

51.5 |

|

10:00 |

EUR |

Unemployment Rate |

10.8% |

10.8% |

10.7% |

|

15:00 |

USD |

ISM Manufacturing Index |

53.4 |

53.0 |

52.4 |

Economic Events scheduled for April 3, 2012 that affect the European and American Markets

T.B.D GBP Halifax House Price Index (MoM) -0.3% -0.5%

The Halifax House Price Index measures the change in the price of homes and properties financed by Halifax Bank of Scotland (HBOS), one of the U.K.’s largest mortgage lenders. It is a leading indicator of health in the housing sector.

10:00 EUR GDP (QoQ) -0.3% -0.3%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

19:00 USD FOMC Meeting Minutes

The Federal Open Market Committee (FOMC) Meeting Minutes are a detailed record of the committee’s policy-setting meeting held about two weeks earlier. The minutes offer detailed insights regarding the FOMC’s stance on monetary policy, so currency traders carefully examine them for clues regarding the outcome of future interest rate decisions.

Government Bond Auctions (this week)

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here