By FXEmpire.com

Crude Oil Fundamental Analysis April 4, 2012, Forecast

Analysis and Recommendations:

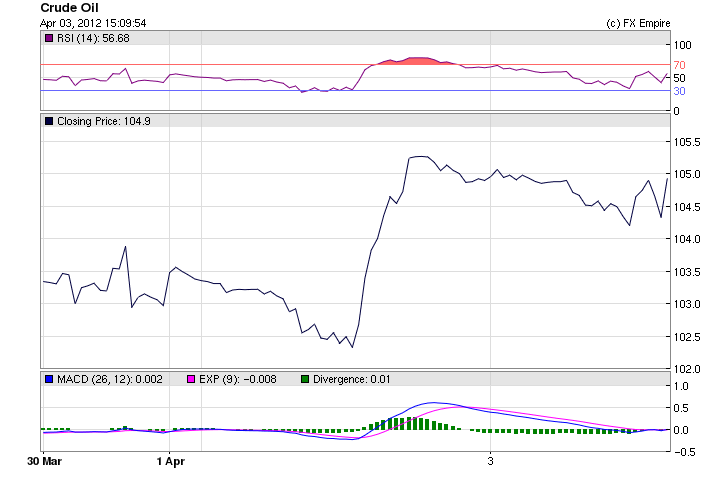

Crude Oil dipped slightly today to trade at 103.95 down 1.27.

U.S. weekly oil data are expected to show crude-oil stocks rose last week while refiners modestly increased operations. According to estimates from 15 analysts surveyed by Dow Jones Newswires, U.S. crude-oil inventories rose by 1.9 million barrels.

The EIA is scheduled to report its weekly data on inventories early Wednesday, with the American Petroleum Institute trade group slated to report its own data later Tuesday.

Analysts polled by Platts forecast an increase of 1.9 million barrels in crude for the week ended March 30. Gasoline stockpiles are seen down 1.6 million barrels on the week, while supplies of distillates are expected to decline 600,000 barrels.

That would follow a surge of 7.1 million barrels for crude in the previous week.

Increases at this time of the year are expected as refineries are in their maintenance period before summer driving season, said Tom Bentz, director at BNP Paribas in New York.

Speculators want to see the inventories numbers before they make their next move.

While a reported halt of Iraqi oil exports from the Kurdistan region and an improvement in the Institute for Supply Management’s manufacturing index for March helped lift crude prices on Monday, weak European manufacturing data kept alive concerns about the possible impact of high oil prices on the region’s economy.

Investors need to continue to worry about the release of strategic reserves as the rising prices have a negative effect on consumer sentiment and on growth and are causing inflation. The Obama Administration will not allow the economy to falter in an election year.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule) -

Heating Oil & Propane Update (October-March)

Heating Oil, Propane Residential and Wholesale Price Data

Release Schedule: Wednesday at 1:00 p.m. EST -

Weekly Coal Production

Release Schedule: Thursday by 5:00 p.m. EST -

Weekly NYMEX Coal Futures

Release Schedule: Monday by 5:00 p.m. EST -

Coal News & Markets

Release Schedule: Monday by 5:00 p.m. EST -

Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) -

Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Originally posted here