By FXEmpire.com

Crude Oil Fundamental Analysis April 6, 2012, Forecast

Analysis and Recommendations:

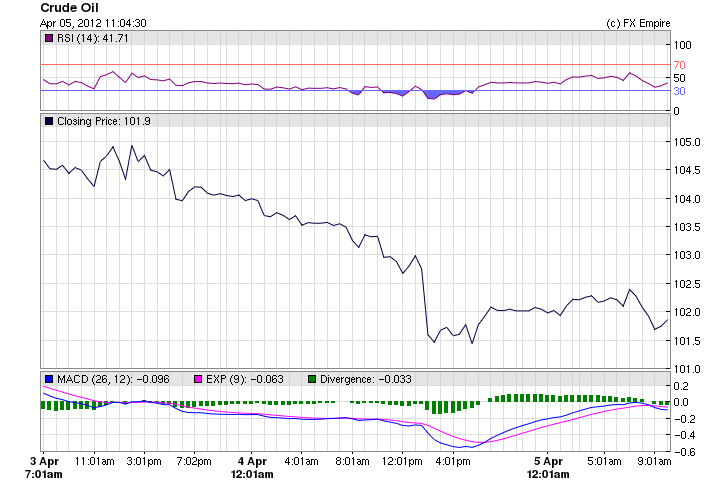

Crude Oil is trading at 102.92 climbing back 1.46 after falling in the previous two sessions.Crude-oil prices bounced off a seven-week low Thursday as lower prices enticed investors back to the market. Crude oil advanced to $102.92 a barrel on the New York Mercantile Exchange.

Prices fell $2.54 in the previous session, joining a global selloff in the equity and commodity markets in the wake of the release of U.S. Federal Reserve meeting minutes and a flare-up in euro-zone debt concerns. Yesterday’s fall came after the Energy Information Administration reported crude stockpiles rose by 9 million barrels nearly five times the increase analysts had expected. Crude-oil futures have lost 4.2% over the past month. They have gained about 3.5% year-to-date.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule)

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 6, 2012 that affect the European and American Markets

13:30 USD Average Hourly Earnings (MoM)

13:30 USD Private Nonfarm Payrolls

Average Hourly Earnings measures the change in the price businesses pay for labor, not including the agricultural sector. Private Nonfarm Payrolls measures the change in the number of total number of paid U.S. workers of any business, excluding general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals and farm employees.

13:30 USD Nonfarm Payrolls

13:30 USD Unemployment Rate

Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for the majority of economic activity. The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

Government Bond Auctions

None scheduled until after April 10, 2012 due to holiday schedule

Originally posted here