By FXEmpire.com

Crude Oil Fundamental Analysis April 9, 2012, Forecast

Analysis and Recommendations:

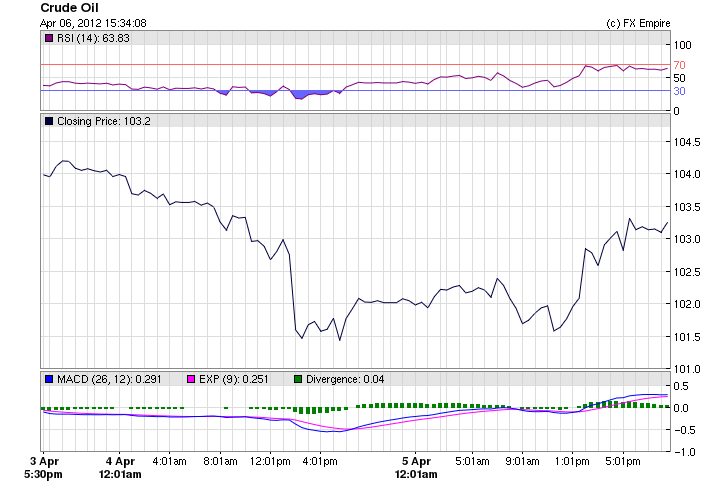

Crude Oil rebounded from the previous session’s selloff as investors did not want to spend the long weekend without some oil futures in their portfolios.

Oil was up $1.84, or 1.8%, to settle at $103.31 a barrel on the New York Mercantile Exchange.

For the week, however, oil futures lost 0.3%.

It is a very quiet day, with global markets closed for the holiday weekend.

The Non Farms Payroll data showed for the first time since November that job growth dropped below the 200,000 level. Economists expected a rise of 210,000. The unemployment rate fell to 8.2% from 8.3%, mostly because more people dropped out of the work force.

In the forex markets, the dollar fell against other major currencies, posting a particularly steep drop against the Japanese yen, which tends to be seen as a safe-haven currency.

Economic Reports for April 6, 2012 actual v. forecast

|

Apr. 06 |

JPY |

Leading Index |

96.6 |

95.6 |

94.5 |

|

EUR |

French Government Budget Balance |

-24.2B |

-12.5B |

||

|

EUR |

French Trade Balance |

-6.4B |

-5.2B |

-5.6B |

|

|

HUF |

Hungarian Industrial Output (YoY) |

1.10% |

-1.00% |

-0.50% |

|

|

USD |

Average Hourly Earnings (MoM) |

0.2% |

0.2% |

0.3% |

|

|

USD |

Nonfarm Payrolls |

120K |

203K |

240K |

|

|

USD |

Unemployment Rate |

8.2% |

8.3% |

8.3% |

|

|

USD |

Average Weekly Hours |

34.5 |

34.5 |

34.6 |

|

|

USD |

Private Nonfarm Payrolls |

121K |

218K |

233K |

|

|

USD |

ECRI Weekly Annualized (WoW) |

1.00% |

-0.40% |

Economic Events scheduled for April 9, 2012

02:30 CNY Chinese CPI (YoY) 3.3% 3.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

02:30 CNY Chinese PPI (YoY) -0.2%

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

10:00 EUR Greek CPI (YoY) 2.10%

Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer.

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule)

Originally posted here