Crude Oil Fundamental Analysis March 16, 2012, Forecast

Analysis and Recommendations:

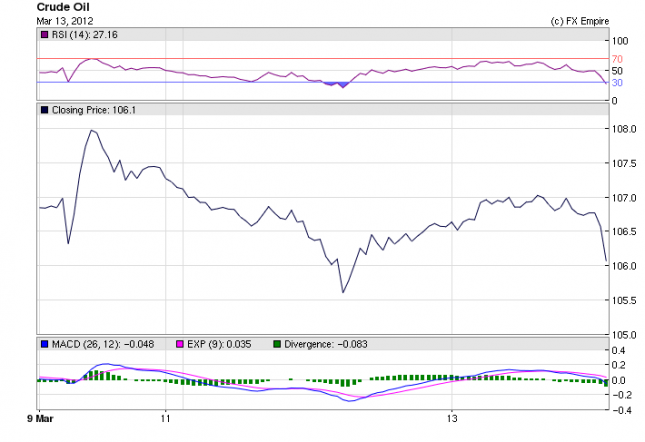

Crude Oil is trading at 104.94 down from the opening of 1.0566 after falling as low as 103.81, as Crude went for a wild ride today.

Earlier in the day, the following news was reported, U.S. president Barack Obama and U.K. Prime Minister David Cameron talked about releasing emergency oil reserves at a meeting on Wednesday in Washington; Reuters reported citing people familiar with the talks.

Later in the day a major news source ran the above story with one major different, the news claimed that Obama and Cameron had reached agreements and would be releasing oil from the strategic reserves.

Within minutes Crude oil tumbled to hit a low of 103.81. Shortly thereafter the story was retracted even the White House made an announcement that the story was false. Crude quickly regained its momentum and has moved up to 104.94 still down for the day.

In likelihood Crude will continue falling slowly, as supply outpaces demand.

Even as optimistic data is released from the US, the decline in China and drops in the G20 GDP will continue to reduce demand, regardless of the oil embargo.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule) -

Heating Oil & Propane Update (October-March)

Heating Oil, Propane Residential and Wholesale Price Data

Release Schedule: Wednesday at 1:00 p.m. EST -

Weekly Coal Production

Release Schedule: Thursday by 5:00 p.m. EST -

Weekly NYMEX Coal Futures

Release Schedule: Monday by 5:00 p.m. EST -

Coal News & Markets

Release Schedule: Monday by 5:00 p.m. EST -

Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) -

Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Released Economic Reports for March 15, 2012 actual v. forecast

|

Date |

Time |

Currency |

Event |

Actual |

Forecast |

Previous |

|

Mar. 15 |

09:30 |

CHF |

Interest Rate Decision |

0.00% |

0.00% |

0.00% |

|

10:00 |

EUR |

ECB Monthly Report |

||||

|

11:00 |

EUR |

Employment Change (QoQ) |

-0.2% |

-0.2% |

-0.2% |

|

|

13:30 |

USD |

Core PPI (MoM) |

0.2% |

0.2% |

0.4% |

|

|

13:30 |

USD |

PPI (MoM) |

0.4% |

0.5% |

0.1% |

|

|

13:30 |

USD |

Initial Jobless Claims |

351K |

356K |

365K |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

20.2 |

17.4 |

19.5 |

|

|

13:30 |

USD |

Continuing Jobless Claims |

3343K |

3405K |

3424K |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

29.3B |

19.1B |

|

|

15:00 |

USD |

Philadelphia Fed Manufacturing Index |

12.5 |

11.4 |

10.2 |

Economic Events for March 16, 2012

Time Currency Event Forecast Previous

13:30 CAD Foreign Securities Purchases 6.27B 7.38B

Foreign Securities Purchases measures the overall value of domestic stocks, bonds, and money-market assets purchased by foreign investors.

13:30 CAD Manufacturing Sales (MoM) 0.60% 0.60%

Manufacturing Sales measures the change in the overall value of sales made at the manufacturing level.

13:30 USD Core CPI (MoM) 0.2% 0.2%

13:30 USD CPI (MoM) 0.4% 0.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

14:15 USD Industrial Production (MoM) 0.4% 0.0%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

14:55 USD Michigan Consumer Sentiment Index 75.7 75.3

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

Government Bond Auction Schedule (this week)

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here