Crude Oil Fundamental Analysis March 19, 2012, Forecast

Analysis and Recommendations:

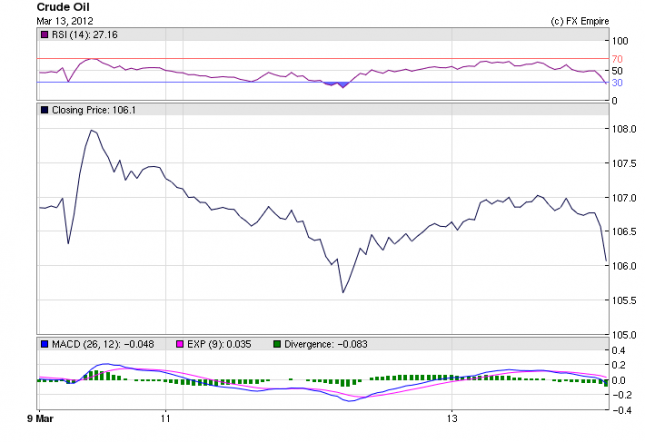

Crude Oil rose 72 cents to $105.83 a barrel on the New York Mercantile Exchange. Prices traded around 1.5% lower week to date. The increase in today’s trading could be on the weakness of the US dollar which turn lower after a report on inflation was seen as giving policy makers more reason to maintain ultra-accommodative monetary measures. There was very little in the way of economic news from either side of the Atlantic.

Western allies continued to turn up the heat on Iran, with the SWIFT banking system agreeing not to process any funds transfer for Iran. SWIFT handles move of the electronic transmissions around the globe. Also it was noted that most insurance or reinsurance on oil shipments are processed through the EU or US, and can no longer cover ships moving Iranian oil, making it difficult to transport the Iranian crude. Even insurance agencies not in the embargo countries can cover the shipments as they cannot share the risk through the reinsurance markets.

U.S. economic data showed continued improvement, but with inflationary pressures starting to rise, [the Fed] may not be able to maintain its ultra-accommodative monetary policy for much longer. Today’s U.S. CPI data could prove to be the main catalyst for trade if it rises above the key 3% level on a year-over-year basis.

U.S. consumer prices increased 0.4% in February, owing mainly to the surging cost of gas, the Labor Department said Friday. The government also reported that inflation-adjusted hourly wages, on average, fell 0.3% in February as higher prices outstripped a 0.1% gain in earnings.

The output of the nation’s factories, mines and utilities was flat in February, the Federal Reserve said Friday. This was well below Wall Street expectations of a 0.4% gain.

Consumer sentiment in March declines for the first time since August, as rising gasoline prices cause a downturn in expectations, according to a key gauge released on Friday.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule) -

Heating Oil & Propane Update (October-March)

Heating Oil, Propane Residential and Wholesale Price Data

Release Schedule: Wednesday at 1:00 p.m. EST -

Weekly Coal Production

Release Schedule: Thursday by 5:00 p.m. EST -

Weekly NYMEX Coal Futures

Release Schedule: Monday by 5:00 p.m. EST -

Coal News & Markets

Release Schedule: Monday by 5:00 p.m. EST -

Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) -

Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Released Economic Reports for March 16, 2012 actual v. forecast

|

EUR |

Italian Trade Balance |

-4.35B |

1.62B |

1.15B |

|

EUR |

Trade Balance |

5.9B |

6.2B |

7.4B |

|

USD |

Core CPI (MoM) |

0.1% |

0.2% |

0.2% |

|

USD |

CPI (MoM) |

0.4% |

0.4% |

0.2% |

|

Foreign Securities Purchases |

-4.19B |

6.27B |

7.38B |

|

|

CAD |

Manufacturing Sales (MoM) |

-0.90% |

0.60% |

0.60% |

Economic Events for March 19, 2012

01:01 GBP Rightmove House Price Index (MoM)

The Rightmove House Price Index (HPI) measures the change in the asking price of homes for sale. This is the U.K.’s earliest report on house price inflation, but tends to have a mild impact because asking prices do not always reflect selling prices.

01:01 GBP Nationwide Consumer Confidence

Nationwide Consumer Confidence measures the level of consumer confidence in economic activity. It is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. Higher readings point to higher consumer optimism.

13:30 CAD Wholesale Sales (MoM)

Wholesale Sales measures the change in the total value of sales at the wholesale level. It is a leading indicator of consumer spending.

Government Bond Auctions (this week)

Mar 19 n/a Greece CDS Auction

Mar 19 10:10 Slovakia Bond auction

Mar 19 10:10 Norway T-bill auction

Mar 20 09:30 Spain 12 & 18M T-bill auction

Mar 21 10:10 Sweden Nominal bond auction

Mar 21 10:30 Germany Eur 5.0bn Mar 2014 Schatz

Mar 21 10:30 Portugal Eur 0.75-1.0bn 4 & 6M T-bills

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here