By FXEmpire.com

Crude Oil Fundamental Analysis March 20, 2012, Forecast

Analysis and Recommendations:

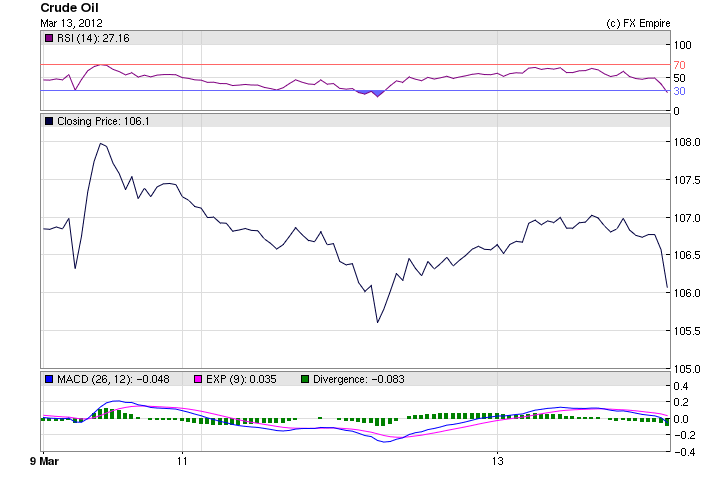

Crude Oil is up +0.89 trading at 108.47 on nonsense; there has been little or no escalation between Israel and Iran, in fact a bit less then just a week ago. There is no way that NATO will allow the Straits of Hormuz to be blockade, without aggressive military action. Saudi Arabia is already pumping more than enough oil to cover the loss of Iranian oil. Iraq is making contingency plans. There is absolutely no reason for oil to be trading at this level, except on market hysteria, and investors pushing up a market so they can sell at huge profits. Regardless of rumors last week about the Strategic Oil Reserves this is what they are the purpose they serve, Obama cannot allow the continued increase of oil and market hysteria to place a damper on US recovery. He will eventually be forced to release some reserves.

As the oil embargo works its magic, and causes pain to the Iranian economy as well as their ego, they will turn up the rhetoric, but they do not want to be confronted by the military power of the west.

With Iran having problems securing insurance for its oil shipments and with SWIFT stopping the money flow, Iran will have to decide which actions to take next.

This price is about to fall.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule)

Economic Data for March 19, 2012 actual v. forecast

|

GBP |

Rightmove House Price Index (MoM) |

1.6% |

4.1% |

|

|

AUD |

RBA Governor Stevens Speaks |

|||

|

EUR |

Current Account |

4.5B |

4.3B |

3.4B |

|

EUR |

Italian Industrial New Orders (MoM) |

-7.4% |

-3.8% |

5.2% |

|

CLP |

Chilean GDP (YoY) |

4.5% |

4.2% |

3.7% |

|

Wholesale Sales (MoM) |

-1.0% |

0.4% |

1.0% |

|

|

USD |

NAHB Housing Market Index |

28 |

30 |

28 |

|

USD |

3-Month Bill Auction |

0.095% |

0.095% |

Economic Events Scheduled for March 20, 2012

13:30 USD Building Permits

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 USD Housing Starts

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

Government Bond Auctions (this week)

Mar 21 10:10 Sweden Nominal bond auction

Mar 21 10:30 Germany Eur 5.0bn Mar 2014 Schatz

Mar 21 10:30 Portugal Eur 0.75-1.0bn 4 & 6M T-bills

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here