By FXEmpire.com

Crude Oil Fundamental Analysis March 27, 2012, Forecast

Analysis and Recommendations:

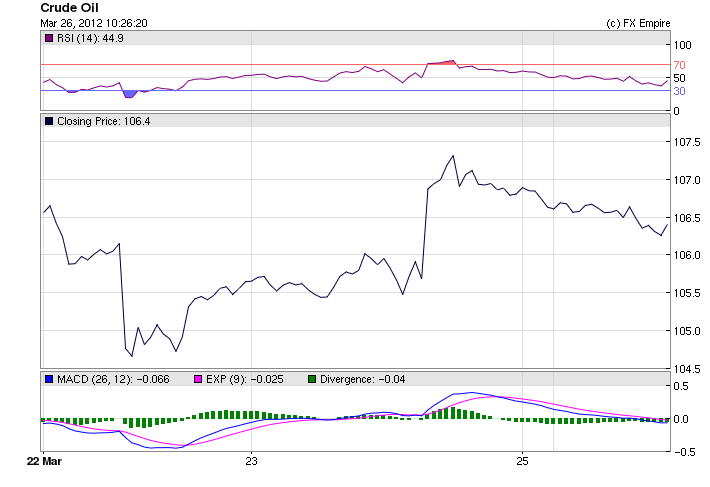

Crude Oil continues to climb holding at 107.11 moving up from the opening at 106.77.

The Saudi’s have been trying desperately to talk down the price, assuring the markets that there is no shortage and that they and OPEC will continue to offset any shortages. The markets are not responding, this is a situation, where supply and demand have been separated by speculators, pushing up prices to take profits from speculation.

The tensions between Iran and Israel have subsided for the time being and the embargo continues to have effects, except this would matter if there was a shortage of supply, but demand is down and supplies are up.

Speculators are going to force Obama’s hand in this matter, as the price is beginning to damage US recovery efforts.

Based on global demands and supplies the price should not be much higher than the 100.00 forecast.

In today’s session, the USD fell, making oil a more attractive purchase, pushing the prices up. Fed Chairman Bernanke said the central bank’s ultra-low interest rate policy can help the labor market, but warned that faster economic growth was crucial to ensuring further recovery.

The improvement in the labor market since last fall may only be a reversal of large layoffs during the recession, and further improvement may depend on faster economic growth.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule) -

Heating Oil & Propane Update (October-March)

Heating Oil, Propane Residential and Wholesale Price Data

Release Schedule: Wednesday at 1:00 p.m. EST -

Weekly Coal Production

Release Schedule: Thursday by 5:00 p.m. EST -

Weekly NYMEX Coal Futures

Release Schedule: Monday by 5:00 p.m. EST -

Coal News & Markets

Release Schedule: Monday by 5:00 p.m. EST -

Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) -

Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Originally posted here