By FXEmpire.com

Crude Oil Fundamental Analysis March 28, 2012, Forecast

Analysis and Recommendations:

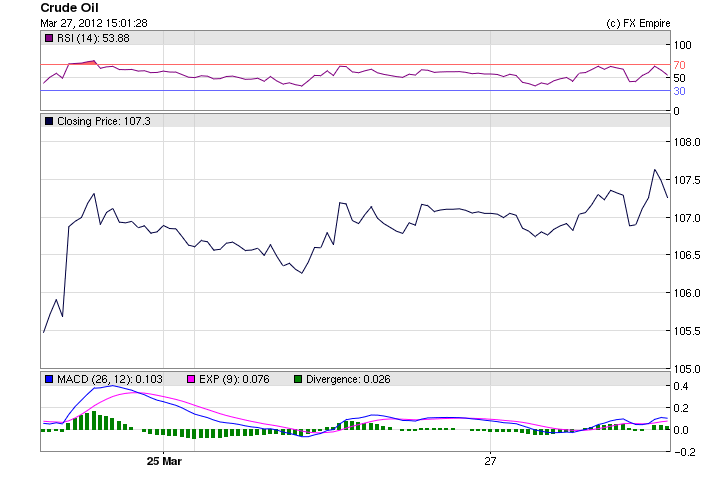

Crude Oil continues to rise, trading up just a tad at 107.25. It seems that speculators continue to push the price regardless of the affects on the global economies and inflation. The OPEC nations continue to keep supply readily available. Demand continues to fall and forecasts for future needs also declines.

Weekly oil data are expected to show crude-oil stocks increased last week while refiners modestly increased operations. According to preliminary estimates from six analysts surveyed.

Today more whispers continue to be heard about the release of US strategic reserves. The markets seem to ignore the persistent rumors, after a false story a week ago sent crude tumbling.

A U.S. Energy Department aide said the U.S. was considering the release of strategic oil reserves.

U.S. President Barack Obama discussed releasing emergency oil supplies with U.K. Prime Minister David Cameron on March 14 but the leaders reached no agreement. This is the meetings that begin the false rumors.

Diplomatic sources revealed today that Iran and six world powers, the U.S., the U.K., France, Germany, Russia and China, have agreed to meet on April 13 for a fresh round of talks regarding Tehran’s nuclear program.

Speculators are going to have no warning when the Obama Administration does make a decision but the economy cannot endure the constant rise of gasoline at the pump or in commercial use. The higher costs are also driving up US inflation.

As the month comes to a close, Obama, might just be tempted to pull the plug before the beginning of April. We might just see oil around the 103-100 range soon.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule) -

Heating Oil & Propane Update (October-March)

Heating Oil, Propane Residential and Wholesale Price Data

Release Schedule: Wednesday at 1:00 p.m. EST -

Weekly Coal Production

Release Schedule: Thursday by 5:00 p.m. EST -

Weekly NYMEX Coal Futures

Release Schedule: Monday by 5:00 p.m. EST -

Coal News & Markets

Release Schedule: Monday by 5:00 p.m. EST -

Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) -

Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Economic Events March 28, 2012 Europe and America

06:30 EUR French GDP (QoQ) 0.2% 0.2%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

09:30 GBP Business Investment (QoQ) -5.4% -5.6%

Business Investment measures the change in the total inflation-adjusted value of capital expenditure made by companies in the private sector.

09:30 GBP Current Account -8.4B -15.2B

The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the nation’s exports the data can have a sizable affect on the GBP.

09:30 GBP GDP (QoQ) -0.2% -0.2%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

T.B.D. EUR German CPI (MoM) 0.3% 0.7%

The German Consumer Price Index (CPI) measures the changes in the price of goods and services purchased by consumers.

13:30 USD Core Durable Goods Orders (MoM) 1.5% -3.0%

13:30 USD Durable Goods Orders (MoM) 3.0% -3.7%

Core Durable Goods Orders measures the change in the total value of new orders for long lasting manufactured goods, excluding transportation items. Because aircraft orders are very volatile, the core number gives a better gauge of ordering trends. A higher reading indicates increased manufacturing activity. Durable Goods Orders measures the change in the total value of new orders for long lasting manufactured goods, including transportation items.

Originally posted here