By FX Empire.com

Crude Oil Fundamental Analysis March 7, 2012, Forecast

Analysis and Recommendations:

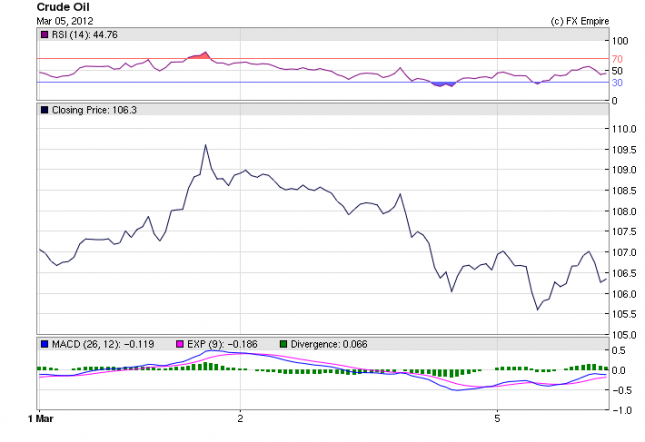

Crude Oil continues to fall, trading at 1.0484 down 1.88. As Mideast tensions seem to ease and the supply disruption seems too passed, with OPEC nations replacing the losses from Iran, the geopolitical pressures pushing crude to the highs are reducing. Investors are now taking time to look into the economic situation in Europe and are beginning to worry about slow down of any economic recovery. With China reducing growth estimates, the demand for oil is lessening. Compound this with worries about the Greek PSI bond swap deadline and the effects of a default or “credit event” the markets are not finding crude oil appealing. Investors are waiting for the EIA inventory due on Wednesday.

Economic Events: (GMT)

WEEKLY

- This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) - Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) - Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule) - Heating Oil & Propane Update (October-March)

Heating Oil, Propane Residential and Wholesale Price Data

Release Schedule: Wednesday at 1:00 p.m. EST - Weekly Coal Production

Release Schedule: Thursday by 5:00 p.m. EST - Weekly NYMEX Coal Futures

Release Schedule: Monday by 5:00 p.m. EST - Coal News & Markets

Release Schedule: Monday by 5:00 p.m. EST - Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) - Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Scheduled Economic Events for March 7, 2012 (GMT)

13:15 USD ADP Nonfarm Employment 205K 170K

13:30 USD Nonfarm Productivity (QoQ) 0.8% 0.7%

13:30 USD Unit Labor Costs (QoQ) 1.2% 1.2%

The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile.

Nonfarm Productivity measures the annualized change in labor efficiency when producing goods and services, excluding the farming industry. Productivity and labor-related inflation are directly linked-a drop in a worker’s productivity is equivalent to a rise in their wage.

Unit Labor Costs measure the annualized change in the price businesses pay for labor, excluding the farming industry. It is a leading indicator of consumer inflation.

Sovereign Bond Auction Schedule

Mar 07 10:10 Sweden Nominal bond auction

Mar 07 10:30 Germany Eur 4.0bn Feb 2017 Bobl

Mar 07 10.30 UK Auctions new Sep 2017 conventional Gilt

Mar 08 16:00 US Announces auctions of 3Y Notes on Mar 12, 10Y Notes on Mar 13 & 30Y Bonds on Mar 14

Mar 08 16:30 Italy Details BOT auction on Mar 13

Mar 09 11:00 Belgium OLO mini bond auction

Mar 09 16:30 Italy Details BTP/CCTeu on Mar 14

Originally posted here