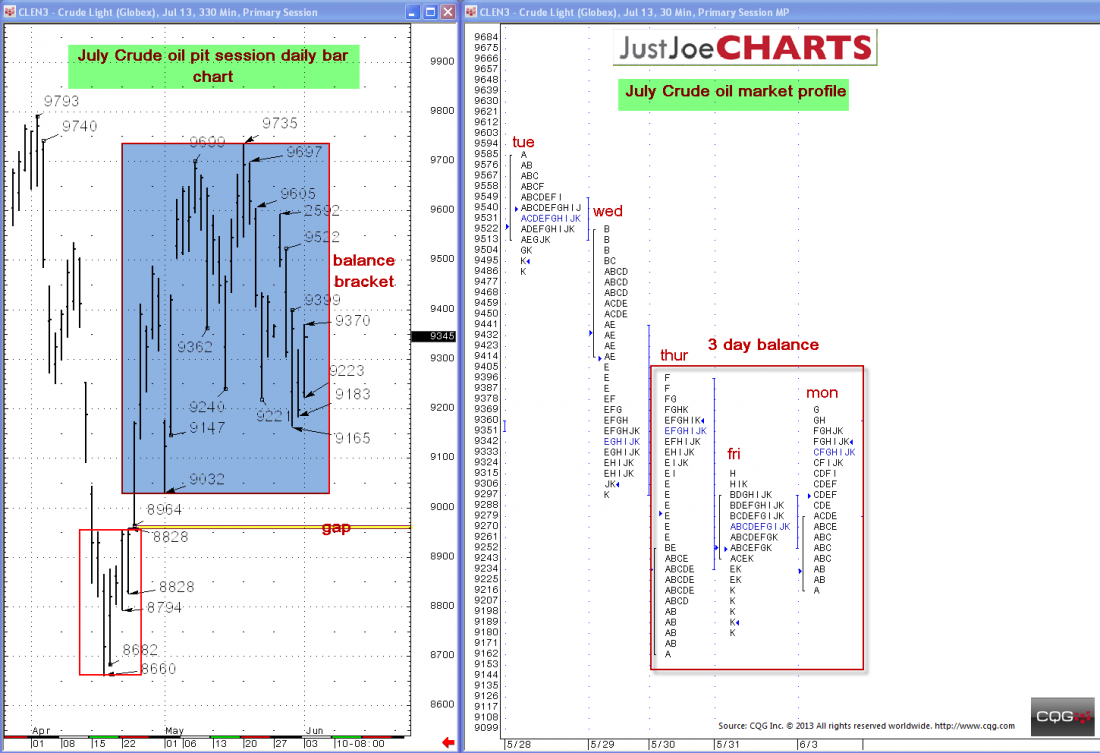

July Nymex crude oil futures have been in a $90.32 to $97.35 balance bracket over the past 28 trading days. Additionally, Friday’s and Monday’s ranges are both within Thursday’s range for a relatively tight three day balance of $91.65 to $93.99. When the market trades outside a balance bracket the two most likely scenarios are the following:

- Gain acceptance outside the balance bracket and accelerate.

- Trade outside the balance bracket and get rejected, which would likely begin a rotation to the opposite end of the balance bracket.

DOWNSIDE SCENARIO

If the market breaks from the three-day balance to the downside, it may test the $90.32 balance bracket low. If the market trades below the $90.32 three day balance low and gets rejected, the $93.99 three day balance high becomes the destination.

UPSIDE SCENARIO

If the market breaks from the three-day balance to the upside, it may test Wednesdays $95.22 high. If the market trades above the $93.99 three day balance high and gets rejected, the $91.65 three day balance low becomes the destination.

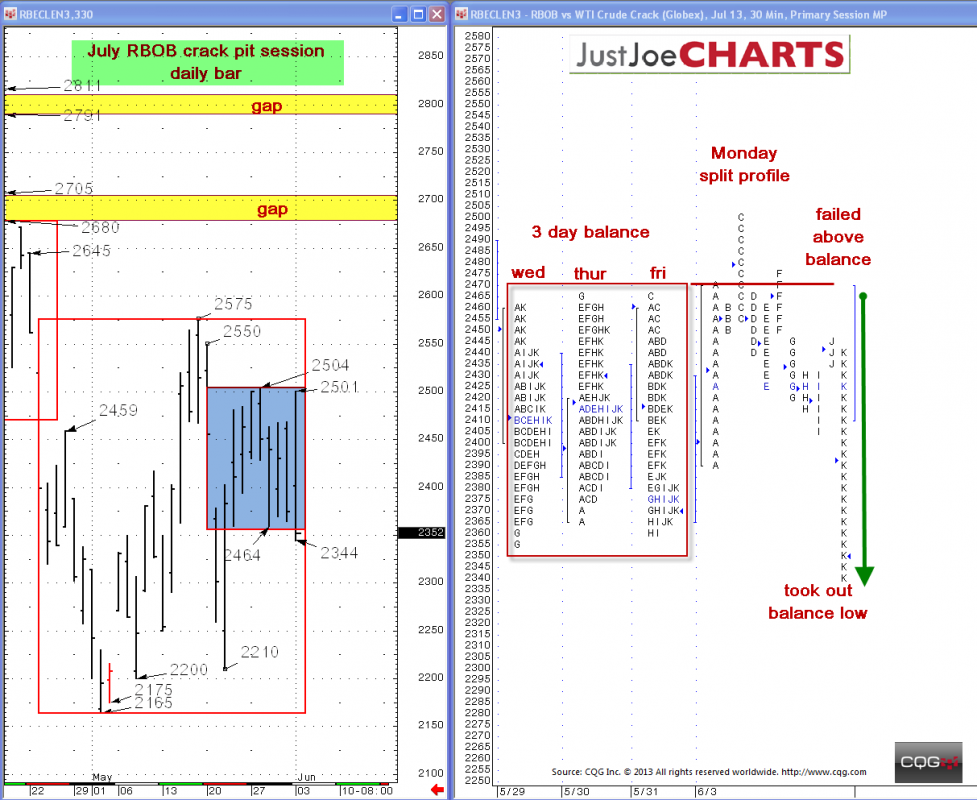

Below is an example of a market (RBOB crack) from yesterday getting rejected above a tight three day balance and then taking out the the three day low at the end of the day.