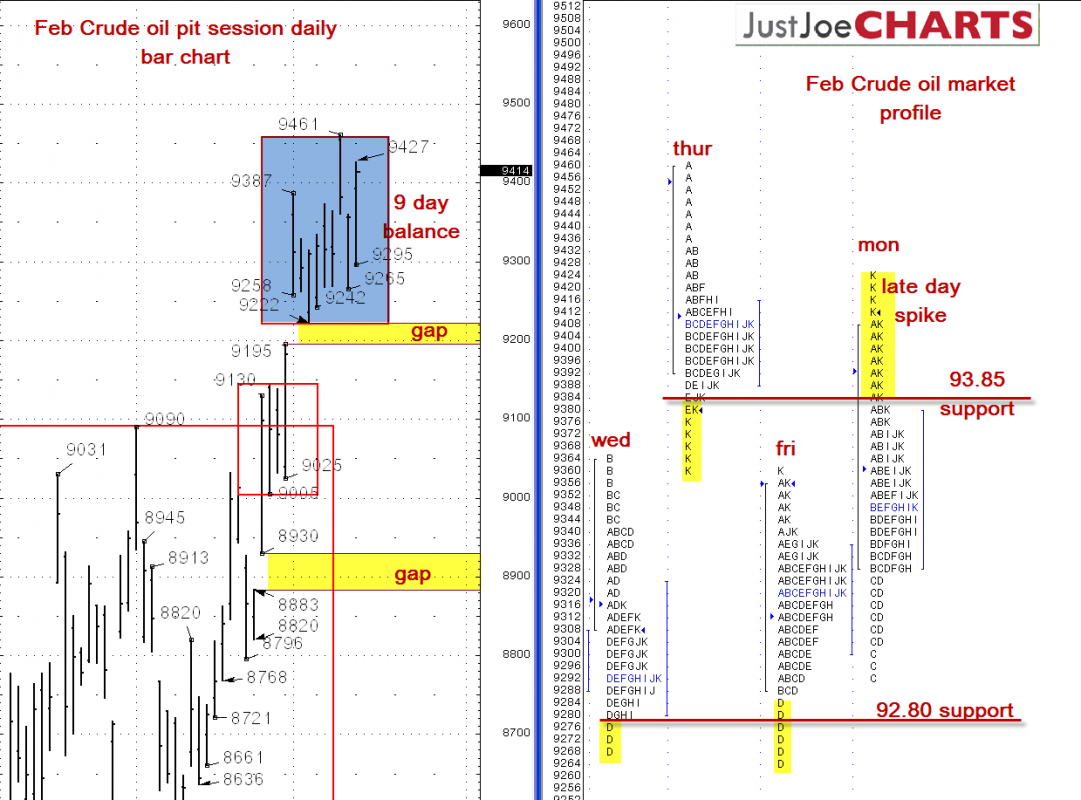

February Nymex crude oil futures has been contained within a relatively tight balance bracket over the past nine trading days. When a volatile market such as crude oil is contained within such a tight balance for an extended period of time, a significant move usually follows the breakout from balance.

FIRST STEP

The first reference to watch for Tuesday’s trading day is the 93.85 support level and Mondays late day spike up. If the market begins to trade above the late day spike, it may test the 94.61 balance bracket high. However, if the market gains acceptance below the 93.85 support, it may test the 92.80 support level below.

UPSIDE BREAKOUT

If the market gains acceptance above the 94.61 balance bracket high, the next upside reference on the weekly/monthly charts is 95.84. Another possible scenario is that the market trades above the 94.61 balance bracket high but is met with sellers and is rejected above the balance. If the market fails to gain acceptance above the 94.61 balance bracket high, a rotation back down to the opposite end of the balance bracket would be a likely scenario, so be patient in entering a trade.