By FXEmpire.com

Crude Oil Weekly Fundamental Analysis April 23-27, 2012, Forecast

Introduction: Crude Oil is considered the king of the commodities markets.

The Strategic Petroleum Reserve is the United States’ emergency oil stockpile, and it is the largest emergency petroleum supply in the world. The reserve stores about 570 million barrels of crude oil in underground salt caverns at four sites along the Gulf of Mexico. Any dipping into this reserve is going to be big news.

Brent Crude is traded in London as something called Futures contracts, which are priced in US Dollars. Now, all you traders brave enough to run your positions over a period of days or weeks, pay attention

Most commonly traded is the NYMEX where you find West Texas Crude. It is also traded in USD.

Analysis and Recommendation:

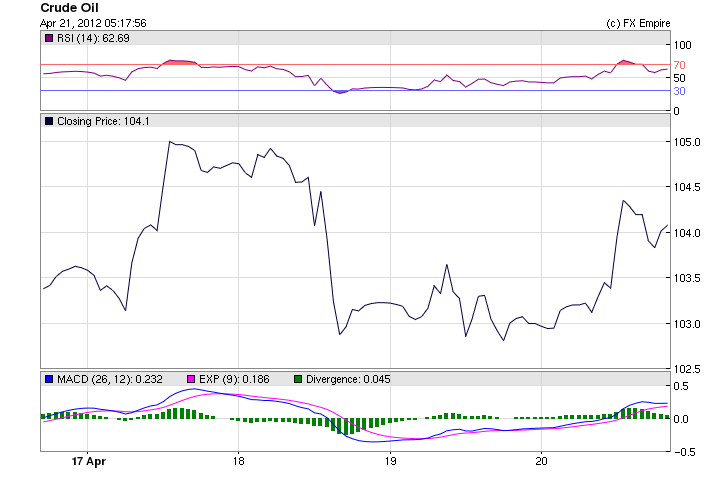

Crude Oil skyrocketed at the end of the trading session on Friday, for no obvious reason. The commodity is trading at 104.08. Speculators are pushing Obama’s hand after he recently asked for authority to control the speculation of crude oil.

As the weekends, worries over Euro Zone debt and economic growth in the US and China continue to grip commodities and were seen trading in a very tight range waiting for fresh cues for further directional moves. In a lackluster trading, spot gold held steady. Base metals in LME traded mostly flat as investors remained cautious after weak economic indicators from the U.S. Though, successful French and Spanish bond auction allayed concerns over Euro Zone’s deteriorating financial health to some extent. Unexpected rise in German business climate assessed by Ifo lifted the sentiments too. LME copper managed to hang above $8000 a ton. In tandem with the international market, movements in MCX base metal complex and bullions were dreary. Crude oil rose for the first time in three days supported by positive German data. Meanwhile, G-20 finance ministers and central bankers are to meet in Washington later today. The Indian rupee was seen bouncing off a 3-month low it hit during previous session at 52.11 up 0.17 percent

Market emotions remained rather subdued in the wake of persistent debt concerns in the Euro region in spite of a strong German business sentiment. Looking into the evening, no major economic data is slated for release. The ongoing G-20 finance minister’s meet in Washington would be the key event markets would be looking up to take cues from. With Chinese economy going through a lean patch, possible Chinese Central bank liquidity action in the coming days could be a marquee event and have a real impact on the commodities.

Iraq will start crude oil loading from a new floating terminal in Basra Friday, the second the country has started operating within a month and a half, which will boost export capacity by another 800,000 to 900,000 barrels a day, a senior Iraqi oil official said

The Energy Information Administration said crude inventories rose 3.9 million barrels in the week ended April 13. That contrasts with expectations of a rise around 400,000 barrels according to analysts

President Barack Obama on Tuesday announced a plan to crack down on what the White House calls manipulation in oil markets. Obama delivered a statement from the Rose Garden on the plan to increase oil-market oversight, the White House said. Energy policy has emerged as a major election-year issue between Obama and Republicans.

The Obama administration proposed new measures Tuesday to limit speculation in the oil markets, seeking to draw a contrast with Republicans who have been calling for more domestic drilling during a time of near record gasoline prices.

Major Economic Events for the past week actual v. forecast

|

USD |

Retail Sales (MoM) |

0.8% |

0.3% |

1.0% |

|

USD |

Core Retail Sales (MoM) |

0.8% |

0.6% |

0.9% |

|

AUD |

Monetary Policy Meeting Minutes |

|||

|

EUR |

ECB President Draghi Speaks |

|||

|

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

|

GBP |

MPC Meeting Minutes |

|||

|

GBP |

Claimant Count Change |

3.6K |

7.0K |

4.5K |

|

CAD |

BoC Monetary Policy Report |

|||

|

USD |

Initial Jobless Claims |

386K |

370K |

388K |

|

USD |

Existing Home Sales |

4.48M |

4.62M |

4.60M |

|

GBP |

Retail Sales (MoM) |

1.8% |

0.5% |

-0.8% |

|

GBP |

Retail Sales (YoY) |

3.3% |

1.4% |

1.0% |

|

CAD |

Core CPI (MoM) |

0.3% |

0.4% |

Historical:

High: 114.57

Low: 76.84

WEEKLY

- This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) - Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) - Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule)

Click here a current Crude Oil Chart.

Originally posted here