IB FX Brief

Currencies await EU press conference

Thursday February 11, 2010

Thursday bears all the hallmarks of being a reporter’s nightmare with fluid market conditions likely to leave market reports out dated before they hit the screen. The Brussels EU summit has announced a press conference at 10:45am ET to deal with the ailing fiscal stance of Greece. The recent jump in forex volatility ensures that relatively few traders will carry speculative positions over the announcement but expect fireworks in the immediate aftermath. The current consensus is that any euro currency gains will be short lived. Earlier in Thursday’s session came a surge in hiring down under and the latest U.S. initial jobless claims data is due at 8:30am ET.

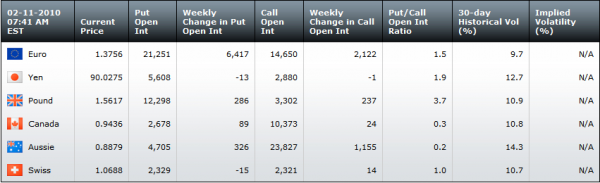

Click on link for updated table throughout the day at http://www.interactivebrokers.com/en/general/education/FX-View.php?ib_entity=llc

Euro – Snow delayed the start of the EU summit in Brussels before its 27 leaders, officials, central bankers and economic advisers hammered out a plan. They are widely expected to reveal a political agreement in dealing with the problems faced by the Greek government given the problems this has created for the single European currency. Expectations are high for a solution but not necessarily resolution.

Traders are braced for a knee-jerk reaction higher for the euro, but many don’t expect any rally to last. First, the plan has to be successfully implemented. Second, the conditions surrounding the assistance will have to be a hit. Third, Greece isn’t the only bad kid outside the headmaster’s office. Spain, Portugal are lining up while even France and the U.K. are pushing their fiscal luck in the playground. It will be interesting to see whether the euro will breach $1.3850 – not too ambitious from its present $1.3716. Meanwhile a watered down solution should see an assault at $1.3600.

U.S. dollar – The dollar index is exactly where it was 24 hours ago and hovering above an index value of 80 against its trade-weighted basket.

British pound – The pound continues to look sickly in light of Wednesday’s inflation report from the Bank of England. At $1.5617 it is higher against the dollar so far having rebounded from $1.5560. Its quarrel today, however, is with the euro. The euro currently buys 87.85 pence after it earlier rose to a three-week high against the pound. Any sustained good news today driving the euro higher is likely to send the euro back above 89 pence.

Aussie dollar – The rate of unemployment slid to its lowest in 11 months and now stands at 5.3%. The market was looking for a reading of 5.6% but was caught off guard by a 52,700 surge in the number of jobs created in January. The Aussie dollar leapt to its highest in a week reaching 89.06 U.S. cents and currently stands at 88.80 cents. A weaker than predicted reading of Chinese consumer price data also buoyed sentiment. The domestic inflation rate, however, led investors to buy the Aussie dollar given the improved chances of further interest rate increases after a February hiatus.

Japanese yen – The yen slipped against the dollar to ¥90.15 as the general risk tone improved. Thursday is a Japanese holiday.

Canadian dollar – A surge in the price of crude oil after an OECD report raised the forecast for demand and helped the Canadian dollar rise to 94.54 U.S. cents on Thursday morning.

Andrew Wilkinson

Senior Market Analyst ibanalyst@interactivebrokers.com

Note: The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Interactive Brokers LLC nor its affiliates warrant its completeness, accuracy or adequacy and it should not be relied upon as such. Neither IB nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this information. Past performance is not necessarily indicative of future results.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities or other financial instruments mentioned in this material are not suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. The information contained herein does not constitute advice on the tax consequences of making any particular investment decision. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation to you of any particular securities, financial instruments or strategies. Before investing, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.