Wednesday closed the day green across the broader markets on increased volume. An accumulation day is good to see for this advance, remember quadruple witching is Friday. We expect volume to climb as positions settle ahead of expiration. Although the market closed green, the close wasn’t on the highs, all indexes finished about mid range. The TRIN closed bearish at 1.21 and the VIX after hitting new yearly lows (16.52) closed at 16.91, just over the January intraday low of 16.86. Gold closed up $2.30 to $1124.80 and oil up $1.23 to $82.93 a barrel.

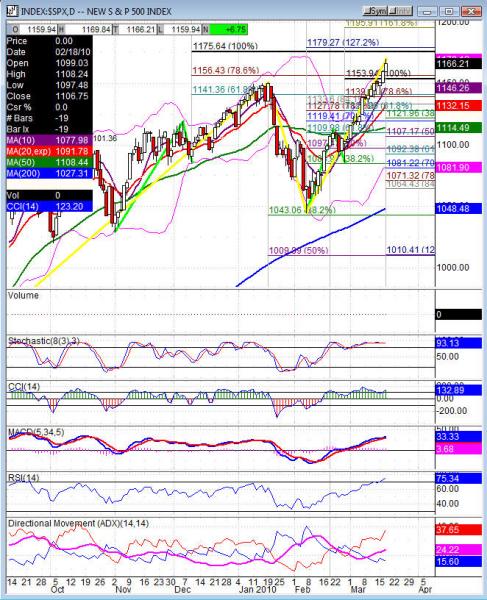

The Nasdaq Composite, Nas 100, S&P 500 and Dow left shooting star candlesticks on the day, which if confirmed are reversal candles. Each index pierced into the upper Bollinger band, each still have a RSI over 70, stochastics mid 90’s and CCI over 100 line support. The days volume hit a big spike as we put in the high on the day, that can sometimes be a sign of fatigue and present a pullback opportunity. The gap and go move also left a gap to fill below us, which will provide support and could keep the bears at bay. Breaking the support will provide the pullback we are looking for and certainly make for a nice pick up in volatility.

With the VIX hitting the January lows, we could double bottom there. The VIX has an inverse relationship to the market. A double bottom coupled with the shooting star on the indexes is reason to be skeptic of further upside until we see a pullback. However, that is pretty obvious and we’ve seen stronger signs than this and never confirm anything. So we’ll just be neutral until we see how the first hour rolls out.

Economic data for the week (underlined means more likely to be a mkt mover): Thursday 8:30 Core CPI, 8:30 Unemployment Claims, 8:30 CPI, 8:30 Current Account, 9:30 FOMC Member Hoenig Speaks, 10:00 Philly Fed Manufacturing Index, 10:00 CB Leading, 10:30 Natural Gas Storage, 12:30 FOMC Member Duke Speaks. Friday nothing due out

Some earnings for the week (keep in mind companies can change last minute: Thursday pre market BKS, FDX, GME, LDK, ROST, WGO and after the bell COMS, PALM. Friday pre market PERY and nothing after the bell.

SPX (S&P 500) closed +6.75 at 1166.21. Support: 1137.82, 1121.96, 1114.49 50dma. Resistance: 1175.64, 1228.74.