Wednesday closed the day red across the broader indexes. Volume came in mixed with the NYSE slightly heavier than yesterday and the Nasdaq was slightly lighter. Futures came in lighter too. The VIX closed at 24.91 after rejecting 26.22 78.6%. The TRIN stayed in a very narrow range to close at .96 neutral on the day. Gold closed up $5.80 to $1175 and oil fell $2.77 to $79.97 a barrel.

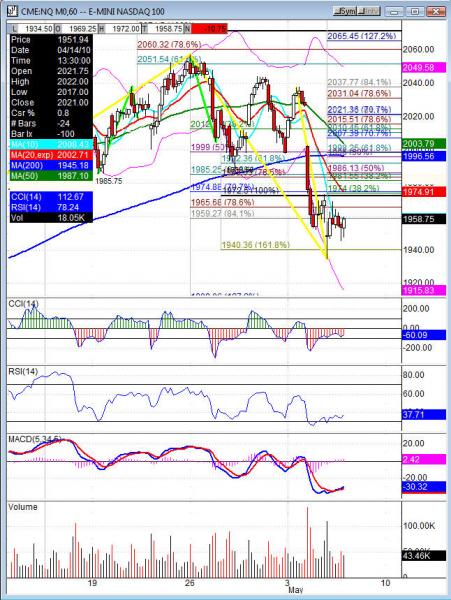

The Nasdaq Composite at 2402.29 closed just 5 points under the 50dma. The Nasdaq 100 closed at 1958.26 about 2 points over the 50dma. The S&P 500 closed at 1165.87 about 2.5 points under the 50dma. The Dow closed about 34 points over the 50dma. All indexes pierced the lower Bollinger band on daily charts and all have the CCI over -200, RSI 41- 44, MACD and stochastics are pointed down and still have some room to move. That CCI is oversold, the RSI is close and the piercing of the lower Bollinger along with the 50dma and 38.2% supports so close. The market is sitting very near key support at those 38.2% levels — COMPX 2369.07, NDX 1927.05, SPX 1152.84 and Dow 10714.50.

Tuesday the market had a nice VIX/TRIN bounce early on to fill the gaps off the weak opening. Now the VIX has a big spinning top off 78.6% resistance, that along with the spinning tops we have on the broader markets leaves the market with indecision and nearby support. Unless the VIX can clear 26.22 a pullback should come in that would push the market higher. Greece is still headline news and oil sinking kept the bulls from taking hold of the market today. However, the expansion on Tuesday left us to look for a narrow range on Wednesday and that was delivered to us. Thursday and Friday the market has economic data to push it around and we’ll continue to watch the Greece news unfold as the EU comes to a vote on aid.

Futures did not test the daily pivot, Tuesday didn’t test either. That is unusual to not see the daily pivot for two days. Which leaves Thursday to be a key area and a magnet most likely. We will probably see a lot of rotation off the daily pivots ES 1164, NQ 1954.25 and TF 699.80. Es back over 1178.25, NQ 1981.5 and TF 712.60 would likely ignite the bulls, but rejection there will give us another leg down.

Economic data for the week (underlined means more likely to be a mkt mover) Thursday 8:30 Unemployment Claims, 8:30 Prelim NonFarm Productivity, 8:30 Prelim Unit Labor Costs, 10:30 Natural Gas Storage. Friday 8:30 Non Farm Employment Change, 8:30 Unemployment Rate, 8:30 Average Hourly Earnings, 3:00 Consumer Credit.

Some earnings for the week (keep in mind companies can change last minute: Thursday pre market ATPG, FNM, FTO, MGM, OMG, OHI, QLTI, SLE, SKYW, and after the bell ADPT, AIG, BEBE, NILE, CEC, HANS, KFT, MRX, NVDA, TS, WTW. Friday pre market AES, CF, HUN, SUG, TTI and nothing after the bell.

NQ (Nas 100 e-mini) Thursday’s pivot 1954.25 weekly pivot 2017.50. Support: 1952, 1948, 1942, 1934.50 Resistance: 1964.25, 1974-1975.75, 1981.55, 1984, 1996-1998.25, 2005, 2012.50, 2019.25, 2027