Monday the Nasdaq Composite and Nasdaq 100 closed modest green in a narrow range day. The SPX and Dow closed modestly red and also in a very narrow range day. The Nasdaq Composite hasn’t traded this narrow since December 29, 2009 and the SPX I looked back for more than 2 years and nothing as narrow as today’s 4.28 point day. Just terrible on every index and that means we are digesting. Volume fell off the map, just nothing to be found moving. The ES actually saw the lightest volume of the year today. The VIX closed at 17.79 still off the 16.86 January 11th lows. The TRIN closed at 1.02 bearish on the day. Gold closed down $10.70 to $1124.50 and oil up 37 cents to $81.87 a barrel.

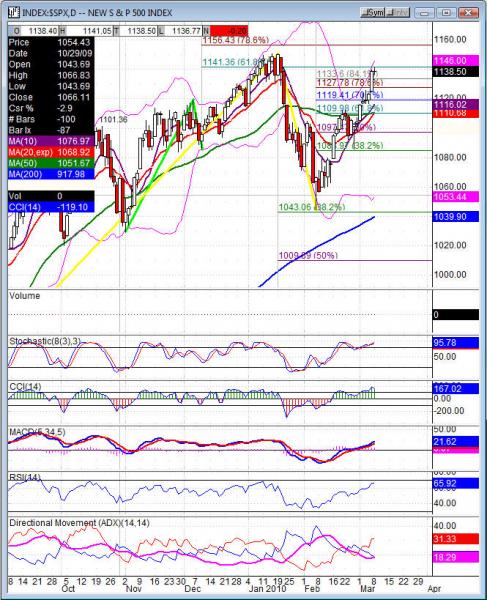

Dismal action doesn’t even start to describe today’s action, but as we know the market sometimes likes to take a really big pause. Pause days result in letting the market be digestive before a move comes to expand the range. Daily chart the NDX and COMPX the stochastics are up at 97-99, RSI 69-70 and just under the upper Bollinger. The Dow and SPX the stochastics are 94-99 and RSI 62-66 not quite as high as the Nasdaq, but certainly reaching exhaustive levels. The CCI on each index is not on extremes because the range was so tight otherwise today would have sent that into exhaustive levels too. Anytime I see the RSI over 70 and stochastics just off 100 you can look for a market to move for a pullback or a lot of sideways action to work that off.

Futures did not test the daily pivot, like the cash indexes the range was dismal. A gap down into Tuesday would not surprise me by days end the action was starting to move into the lows on the day. The futures indexes left lower highs by late afternoon and closed very near the lows leaving an open gap below us for support. Look for 1130.25 on the ES, a break of that level would let us look as low as 1118.50.

Economic data for the week (underlined means more likely to be a mkt mover): Tuesday 10:00 IBD/TIPP Economic Optimism. Wednesday 10:00 Wholesale Inventories, 10:30 Crude Oil Inventories, 2:00 Federal Budget Balance. Thursday 8:30 Trade Balance, 8:30 Unemployment Claims, 10:30 Natural Gas Storage. Friday 8:30 Core Retail Sales, 8:30 Retail Sales, 9:55 Prelim UoM Consumer Sentiment, 9:55 Prelim UoM Inflation Expectations, 10:00 Business Inventories.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market DKS, KR, NXG and after the bell JCG. Wednesday pre market AEO, PLCE, QLTI, and after the bell BLDP, FCEL, GYMB, HOTT, IPAR, JAS, MW, SMTC, WES. Thursday pre market ARIA, IMAX, NGPC, NPSP, GASS, and after the bell GG, NABI, NSM, PSUN, SEAC, SHFL, ZUMZ. Friday pre market ANN, KIRK, PEI and nothing after the bell.

SPX (S&P 500) closed -.20 at 1138.50. Support: 1110.75 50dma-1103.14 38.2%, 1080.74, 1064.80. Resistance: 1150.45 1/19 swing high, 1156.43, 1175.64.