Tuesday the market moved higher on heavier volume. Monday’s volume was anemic and Tuesday managed to move slightly higher with marginally more participation. However, the market is still well below average volume. The S&P 500 moved to a 17 month high, Nasdaq to a 18 month high after the Fed said it would keep interest rates low for an extended time. There was no surprise change in the statement and financials liked what they heard. The VIX closed at 17.69 and the TRIN very low at .53. Gold rallied to close at $1122.30 +16.90 and oil up $1.90 to $81.70 a barrel.

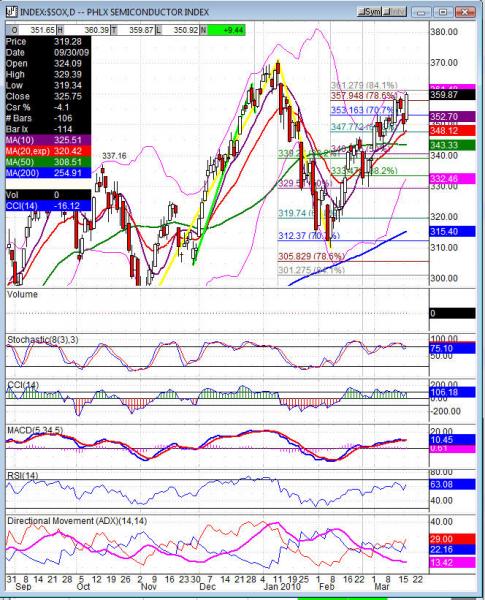

The leadership in financials is not where we look for leadership, but we got it from those sectors today. The Semi’s (SOX) was very strong and held up well but they left the hardware as the weakest sector which left the Nasdaq under pacing the SPX on the day. A strong A/D and U/D line with the low TRIN helped to support the move with higher volume today. Which leaves me less weary of the lift and if the Nasdaq had been the index leading I would have no problems with today at all. The daily charts on the NDX, SPX, and the Dow all have the upper Bollinger nearing, RSI 72-75, stochastics flat in the mid 90’s and the CCI just over 100. Intraday and daily charts are nearing overbought levels, but there is still some room to move.

Good data on Wednesday just maybe the fuel the bulls need to come out strong Wednesday morning. Any disappointment could start opening the profit takers gates and let us pullback. Futures did not test the daily pivots, Wednesday’s are not far off Tuesday’s close so they should be seen with little effort Wednesday as a rotational level. I would expect another quiet night session and even for this tight range to continue. The slow move up each day is not full of momentum, but the bulls are holding the trend. The market is seeing overbought conditions and divergence persist each day while the bulls continue on. Which is not normally something we see for extended periods but as the market takes these baby steps up there is no way to second guess it until the pullback comes in. A pullback would likely correct most of the lacking momentum and put things in an orderly pattern. Finding that pullback maybe a long wait though, so we just have to go with it.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 8:30 PPI, 8:30 Core PPI, 10:30 Crude Oil Inventories. Thursday 8:30 Core CPI, 8:30 Unemployment Claims, 8:30 CPI, 8:30 Current Account, 9:30 FOMC Member Hoenig Speaks, 10:00 Philly Fed Manufacturing Index, 10:00 CB Leading, 10:30 Natural Gas Storage, 12:30 FOMC Member Duke Speaks. Friday nothing due out

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market GIS, SMTS and after bell MLHR, HIS, NKE. Thursday pre market BKS, FDX, GME, LDK, ROST, WGO and after the bell COMS, PALM. Friday pre market PERY and nothing after the bell.

SOX (semiconductor) closed +9.44 at 359.87. Support: 355.66, 354.20, 352.74, 351.64, 348.75. Resistance: 361.27, 363.55, 366.62 1/11 gap, 370.91