Thursday closed the day on the highs and right back to the area we fell from on the Greece/Portugal news on Tuesday. The advance left the market with a lighter volume lift on the NYSE and heavier volume on the Nasdaq. The TRIN was high until the final hour and it fell off to close at .79. The VIX closed at 18.44 just off the 17.94 lows from Tuesday. Gold closed the day at $1166 down $5.80 and oil closed up $1.95 to $85.17 a barrel.

The action was a little choppy off the opening today, the market was at a tug of war with sellers and buyers. That was evident by the high TRIN throughout the first half of the day. After the bell CSTR, PWER, WYNN all traded up nicely off earnings, MFE, QLGC, MXIM, MET all traded lower off earnings. The big shocker for the market after the bell came with Goldman Sachs (GS), yep more BS with GS (sorry that was too easy). The fed’s are now involved and looking into criminal wrong doing, not just the civil case that the market was already digesting. GS closed at $160.18 and barely a change after the initial drop and then rebound. Futures didn’t hold as steady and showing some concern. We may see more as Europe opens with the Greece, Portugal and Spain problems leaving the market with wobbly legs and now this.

Going into a Friday with uncertainty is the last thing the market wants. I will look for some pressure early on the market. If there isn’t any we look for the bulls to say…SEE none of it matters. I won’t hold my breath awaiting that comment, but you all know what I am saying. We have shrugged off some really surprising stuff lately, so this may or may not be another blip on the screen. We are likely to find out early in the day just how much the market can shrug off. I think we see selling pressure and then find some range to finish the day in. I don’t have a lot technically to base that off, the market is trending up and strong. Indicators are still headed up and if we clear Tuesdays highs that erases the week’s drop and the ship sails north. So my thought it we see the pressure off the uncertainty.

Economic data for the week (underlined means more likely to be a mkt mover) Friday 8:30 GDP, 8:30 Advanced GDP Price Index, 8:30 Employment Cost Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Friday pre market AGN, CVX, DHI, LPNT, NDAQ, VFC and nothing after the bell.

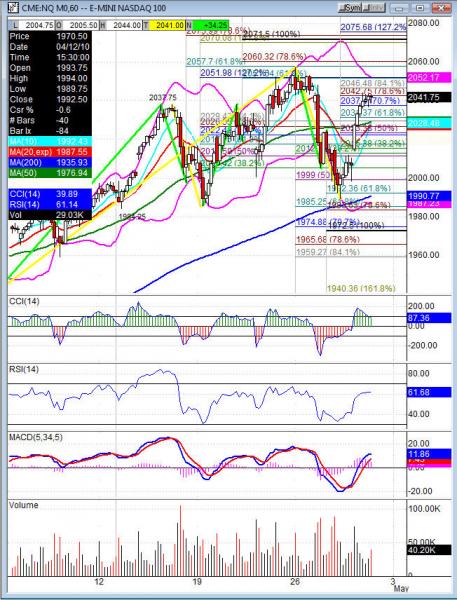

NQ (Nas 100 e-mini) Friday’s pivot 2033.50, weekly pivot 2030.50. Support: 2032.25, 2028.75, 2022.75, 2016.50, 2010, 2006.75, 2001. Resistance: 2042.75, 2046.50, 2053, 2057.25, 2060.50