Thursday brought a distribution day across the broader markets off a weak start that only got worse as the day continued. Volume came in heavier on the NYSE and Nasdaq, but futures were by far higher, even more than Monday’s accumulation day. The TRIN closed at 1.71 and the VIX at 22.67. A late day bounce trimmed the losses on the market and brought the TRIN and VIX off higher levels too. Gold closed up $1.00 to $1142.60 and oil down $2.08 to $77.50 a barrel.

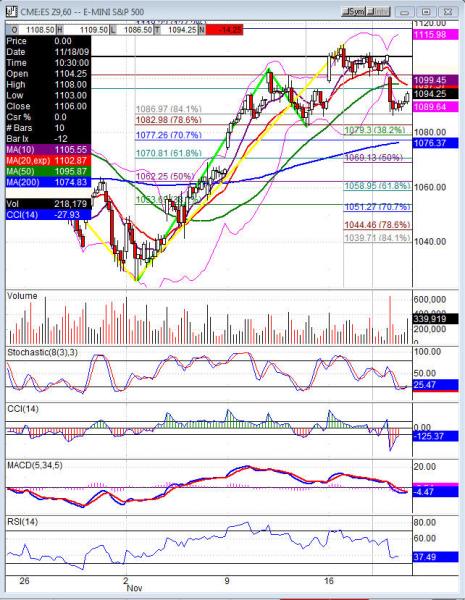

The drop came following the three days forming the reversal off the highs, it also brought all the indicators down. The CCI is just over 0, stochastics turned down, RSI fell off, MACD is touching and could cross down now with any further downside. Making for a bearish start on a pullback, however one day does not turn a bull market. Until the market drops the prior swing low and retraces further the word reversal can’t really be used. A pullback is good and this is a start for a retracement. The 50dma’s are just under us and the 10dma and 20dema are just pulling in, watch for the shorter term ma’s to start coming through the longer term. On the 65 minute a swing low from 11/12 is holding as support on the COMPX, NDX, SPX and the Dow. That support could allow for a right shoulder to form for a head and shoulders pattern or continue to hold and push the market back up. Dip buyers step in every time the market shows weakness so we won’t rule that out until we see the bears maintain control.

Futures did test the weekly pivots, ES used 1086.5 weekly pivot as the LOD (low of day) and bounced nicely. The NQ dipped below but closed right on the weekly 1769.50 pivot. The TF dipped below and closed under the 585.5 weekly pivot. Futures also fell below S3 today, but closed back inside that range, it is very unusual to drop those levels and not retreat to them. That is why the pivots along with Resistance and support levels 1-3 are on the site daily. They can define the extremes to expect as well as the pivots for rotation levels. Friday of expiration is generally a quiet day for range and volume plays tug of war all day. After the expansion we saw on Thursday even if it wasn’t expiration I would expect some digestion. Which until proven different is what to expect on the day and that means don’t overtrade.

Economic data for the week (underlined means more likely to be a mkt mover): Friday nothing due out. Monday 10:00 Existing Home Sales. Tuesday 8:30 Prelim GDP, 8:30 Prelim GDP Price Index, 9:00 S&P/CS Composite 20 HPI, 10:00 CB Consumer Confidence, 10:00 Richmond Manufacturing Index, 2:00 FOMC Meeting Minutes. Wednesday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Core PCE Price Index, 8:30 Durable Goods Orders, 8:30 Personal Spending, 8:30 Personal Income, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations, 10:00 New Home Sales, 10:30 Crude Oil Inventories, 12:00 Natural Gas Storage. Thursday US Markets are closed Happy Thanksgiving. Friday nothing due out.

Some earnings for the week (keep in mind companies can change last minute: Friday pre market ANN, DHI, SLM, KIRK and nothing after the bell. Monday pre market BJS, TSN and after the bell HPQ. Tuesday pre market AEO, BKS, BRCD, DLTR, HNZ, MDT and after the bell JCG, TIVO. Wednesday pre market DE, TIF and after the bell ZLC. Thursday US markets are closed. Friday pre market FRO, SFL and nothing after the bell.

ES (S&P 500 e-mini) Friday’s pivot 1093.75, weekly pivot 1086.50. Intraday support: 1088.75, 1086.50, 1082.50, 1079.25 38.2%, 1074.50. Resistance: 1096.50, 1099.50, 1102.50, 1106.75, 1108.50 fills gap-1109.50, 1112.25, 1116, 1118.25, 1124, 1129.50