Friday closed the day green on with volume behind it to come in nicely for an accumulation day. Futures volume was the best we’ve seen since early November, which came from the reversal off the highs and then reversal off the lows bringing in participation. The week closed green and near the highs. Each index (NDX, COMPX, SPX, Dow) traded to new intraday highs, but once again rejection came into play. The market had a huge gap off good economic news and slipped throughout the day to drop Thursdays lows, but close back within Thursdays range. Very disappointing to hit new 2009 highs again and reject the move to close lower. The TRIN closed at .87 and the VIX at 21.25 while the A/D line was mid range and U/D closed on the highs. Gold had a serious meltdown closing off $49.30 to $1169 and oil off 81 cents to $75.65.

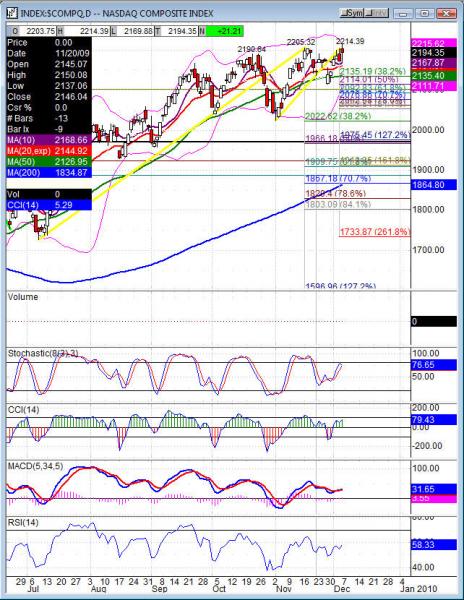

After rejecting the move up, that kind of outside move and closing back within range can be a bearish indicator for the market. Looking at the daily charts the September, October chopped sideways into a channel the middle of the month to then pullback and then move higher to a new swing high. November was setting up for the same pattern mid month, but the pullback never came off the channel and we remain in the channel. Sitting in range since mid November is telling us very little. However the rejection to break out after several attempts is starting to wear thin on the market. Along with the rejection the RSI is flat in the 50’s, CCI is nearing 0 line support, MACD is flat and stochastics started to cross down Friday. The moving averages are still in bullish order and the upper Bollinger is starting to slope downward for each broader market.

Into next week we are likely to have more of the same with some up and some down until we break this range. I expected the Job’s data to be our catalyst to move out of range, but that didn’t do it. This week the first half of the week could be very quiet and we’ll keep an eye on the Semiconductors and telecom sectors (SOX and XTC). They have been leading advancers for the tech and now reaching toppy levels into resistance. That will be key into next week for any advance to see those two sectors continue. Banks and brokers have lagged the move up with the tech sectors (hardware, sox, telecom, internets) and sit WELL under the October highs unlike the other sectors. Friday’s advance off the BAC news to repay the TARP let financials have an initial reaction but then nothing came in to back it up. Leaving us to look for a pullback at this point, but stay pretty neutral until this channel breaks.

Economic data (underlined means more likely to be a mkt mover): Monday 3:00 Consumer Credit.

COMPX (Nasdaq Composite) closed +21.21 at 2194.35. Support: 2152.34, 2135.40 50dma-2144.60 fills gap, 2092.83. Resistance: 2214.39 2009 highs, 2267.66, 2294.18-2300.81.