Friday left the market on the lows with another red day. Volume was slightly less than Thursday’s so we did not have another distribution day on the NYSE and Nasdaq, but futures did. Volume was still better on the NYSE and Nasdaq than we had seen all week. Five out of the last 9 trading days were red, leaving four as up days, for a pretty split last two weeks on this market, but what stands out is the volume being heavier on the down days. The VIX closed at 27.31, a level the market hasn’t traded up to since November 4th. The TRIN closed at 1.61 bearish on the day. Gold traded lower to $1092 off $11.20 an ounce and oil down $1.54 to $74.54 a barrel.

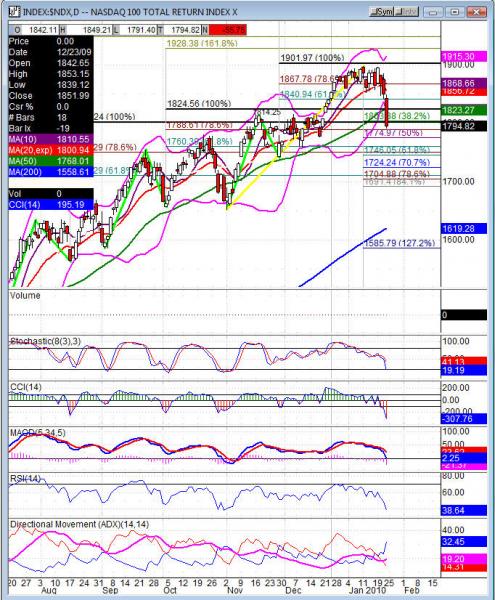

First on the list of things to pay attention to is the break of the 50dma’s on the COMPX (Nas Composite), NDX (Nas 100) and SPX (S&P 500), the Dow traded for the second day under the 50dma. Now the COMPX, NDX and SPX will need a confirmation of the break with another day down. After Friday’s fall the CCI is -300, RSI at 36-39 and Stochastics 17-19 with the MACD still pointed down. Leaving the CCI oversold and the RSI very close, once we see that drop under 30 that raises the red flag and stochastics into single digits will be important to watch too for an oversold bounce. Marubozu candle on the daily and weekly candles leave the market still bearish, but looking for a short term oversold bounce. Wednesday, Thursday and Friday left the first three days the market has seen since October 23rd, that coupled with the distance we’ve fallen in a few days leaves the market a little more room before becoming oversold in the bigger picture (daily charts).

Next week is the final trading week for January and given the drop and where we sit now. The SPX and Dow would be red on the month with the Nasdaq very close to giving up the January gains. Earnings continue to roll out next week with big caps everyday that can move the market. Economic data has a Fed meeting in the mix this week and on top of ALL of that we have until the 31st to see if Congress will reconfirm Fed Chairman Bernanke for a second term. The market will not like the uncertainty of leadership and this could create havoc with any news related item. We could see individual Senators commenting and letting their votes known publically. I don’t think there will be a vote at all if they aren’t sure of the numbers being there to confirm him, but we’ll have to wait and see on this one. I think at the end of the day he’ll get confirmed, however having said that everyone is looking to point a finger and a fall guy right now for this economic crisis and he maybe that scapegoat. So nothing is certain and there is nothing that makes the market more nervous than uncertainty. Look for a jittery market if this gets ugly and all the replacement names start popping up. Especially with a Fed meeting this week, seat belt in!

Economic data for the week (underlined means more likely to be a mkt mover): Monday 10:00 Existing Home Sales. Tuesday 9:00 S&P/CS Composite-20, 10:00 Consumer Confidence, 10:00 HPI m/m, 10:00 Richmond Manufacturing Index. Wednesday 10:00 New Home Sales, 10:30 Crude Oil Inventories, 2:15 FOMC Statement, 2:15 Federal Funds Rate. Thursday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Durable Goods Orders, 10:30 Natural Gas Storage. Friday 8:30 Advance GDP, 8:30 Advance GDP Price Index, 8:30 Employment Cost Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Monday pre market AKS, HAL, and after the bell AMGN, AAPL, TXN, VMW, ZION. Tuesday pre market GLW, DAL, DD, EMC, JNJ, NUE, TRV, X, VZ, and after the bell GILD, QLGC, RFMD, STLD, STM, SYK, WMS, YHOO. Wednesday pre market ABT, APU, BJS, BA, CAT, COP, DSPG, GD, HES, OSIS, UAUA, UTX, VLO, WLP and after the bell AMLN, BMC, ETFC, FLEX, ISIL, NFLX, NE, NSC, QCOM, RYL, JAVA, VAR. Thursday pre market MMM, ALK, MO, T, CP, CAH, CL, LLY, F, JBHT, JBLU, LLL, LMT, MOT, NOK, OXY, OSTK, POT, PG, TYC, UA, LCC, ZMH, and after the bell AMZN, AMCC, CA, DLLR, JNPR, KLAC, LSCC, MXIM, MSFT, PMCS, RMBS, SNDK, VSEA, YRCW. Friday pre market CVX, FO, HON, MAT, NS, and nothing after the bell.

NDX (Nasdaq 100) closed -55.75 at 1794.82. Support: 1774.97, 1746.05, 1704.88, 1652.44 Resistance: 1831.93, 1856.96, 1874.79, 1901.97