|

Friday closed the day red across the broader markets erasing Wednesday and Thursdays gains. The Dow closed strongest to be followed by the SPX then the NDX, COMPX and RUT followed. The week did post a gain and the month is still moving higher. Volume on Friday was heavier than Thursday, futures were also higher. The VIX closed at 16.97 and the TRIN at 1.34. Gold fell $2060 to $1106.90 and oil dropped $1.52 to $80.68 a barrel. The A/D and U/D Lines trended lower all day Friday and closed just off the lows. On the daily SPX, NDX, COMPX, Dow and RUT the stochastics are starting to turn down, RSI falling to 70-69, MACD the lines are together, CCI falling. One down day pulled us off the overbought conditions and off the upper Bollinger band on those daily charts. The moving averages are still in bullish order and we sit over 10dma by a small margin on each index, another down day would put us right on those 10dma’s. We haven’t closed a day under the 10dma since Feb 23 with this slow crawl up. On the weekly charts the October 2007 highs to the March 2009 lows the Dow has retraced over 50% of the losses and sits 200 points under 61.8% (11245). The Nas Composite is just under 2393.88 70.7%, Nas 100 1982.68 78.6% is the next big resistance level, and the SPX has moved to new highs nicely but still under 1228.74 61.8% resistance. All are into the upper Bollinger band on the weekly, stochastics are into 90, CCI over 100 and the RSI is up to mid 60’s. The moving averages 10ma, 20ema and 50ma are in bullish order but the 200ma is still out of order. Early Monday look for the market to have some shake out off the healthcare bill. They were suppose to vote Sunday and we’ll see if that takes place and the impact if they do or don’t. The market started to bounce very late day after finding some support and being short term oversold. The S&P 500 rebalancing let the SPX see the biggest late day move. There will be shake out from that too. With no data on Monday we could see a very slow opening and digest Friday’s fall. We did see the range open some, but not enough to get overly excited about a pullback. Every small dip has been bought and until we see Friday’s low break I would expect to see dip buyers again come in. |

Economic data for the week (underlined means more likely to be a mkt mover): Monday nothing due out. Tuesday 10:00 Existing Home Sales, 10:00 HPI m/m, 10:00 Richmond Manufacturing Index. Wednesday 8:30 Core Durable Goods Orders, 8:30 Durable Goods Orders, 10:00 New Home Sales, 10:30 Crude Oil Inventories. Thursday 8:30 Unemployment Claims, 10:30 Natural Gas Storage. Friday 8:30 Final GDP, 8:30 Final GDP Price Index, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Monday pre market BPZ, TIF, WAG, WSM and after the bell PVH. Tuesday pre market KBH, SCS and after the bell ADBE, DRI, JBL, SONC. Wednesday pre market CMC, GIS, LEN, RBN and after the bell PAYX, CKR, RHT. Thursday pre market BBY, CAG, LULU, SCHL, GASS, TXI, UTIW and after the bell CAN, FINL, ORCL, PBY, TBIX, WTSLA. Friday nothing due out.

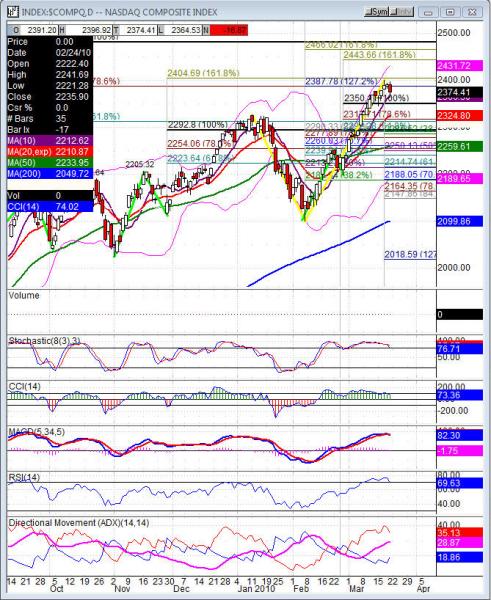

COMPX (Nasdaq Composite) closed -16.87 at 2374.41. Support: 2323.16, 2285.52 38.2%, 2259.61 50dma-2250.13, 2214.74. Resistance: 2393.88, 2473.20 8/18 swing high, 2519.97