Friday closed the day green across the board on heavier volume. A nice accumulation day for the broader markets. The VIX closed at 17.42 getting closer to the 16.86 the January 11th lows and the lowest level since May 2008. The TRIN closed at .42 very bullish along with a very bullish A/D and U/D lines. Gold closed up $4.40 to $1137.50 and oil up $1.29 to $81.50 a barrel.

Friday closed the day green across the board on heavier volume. A nice accumulation day for the broader markets. The VIX closed at 17.42 getting closer to the 16.86 the January 11th lows and the lowest level since May 2008. The TRIN closed at .42 very bullish along with a very bullish A/D and U/D lines. Gold closed up $4.40 to $1137.50 and oil up $1.29 to $81.50 a barrel.

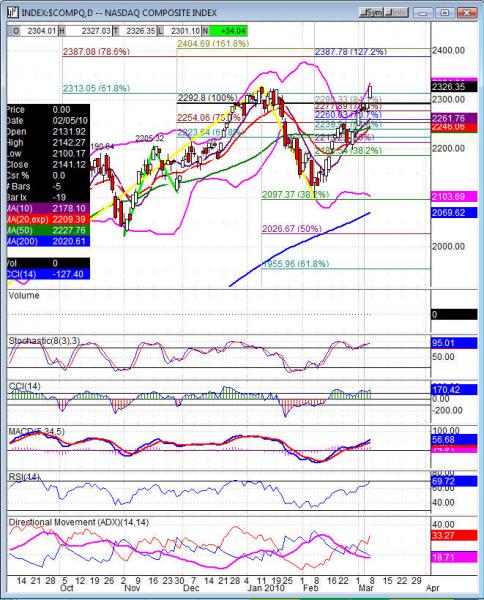

The Nasdaq Composite and Russell 2000 moved to new highs for the year, the Nas 100, S&P 500 and Dow remain under the January highs. The daily charts are into the upper Bollinger Band, Stochastics are 91-95, RSI are 63-69, CCI all over 150 and the MACD pointed up. With the move the market saw on Friday with the gap up we are short term over extended. That doesn’t mean the market won’t remain over extended for awhile. However, it does mean the market will struggle to move up and will need a great deal of participation to keep pushing higher without a pullback.

Futures did not test the weekly pivot, they did the prior week and missed the week before that. That is very unusual, normally we wouldn’t see the market miss the weekly pivot more than once in 6-7 weeks. The daily has also been very hit and miss this past week with only 2 days of the last 5 testing the daily pivot. That is outside of the normal and the low volume we’ve seen is really making the market on edge. Monday I’d like to see a pullback and if that is on lighter volume it will help the bulls to retest the highs and see if the NDX, SPX and Dow catch up to the Nas Composite and Russell 2000.

Economic data for the week (underlined means more likely to be a mkt mover): Monday nothing due out. Tuesday 10:00 IBD/TIPP Economic Optimism. Wednesday 10:00 Wholesale Inventories, 10:30 Crude Oil Inventories, 2:00 Federal Budget Balance. Thursday 8:30 Trade Balance, 8:30 Unemployment Claims, 10:30 Natural Gas Storage. Friday 8:30 Core Retail Sales, 8:30 Retail Sales, 9:55 Prelim UoM Consumer Sentiment, 9:55 Prelim UoM Inflation Expectations, 10:00 Business Inventories.

Some earnings for the week (keep in mind companies can change last minute: Monday pre market BPZ, and after the bell NCTY, TIVO. Tuesday pre market DKS, KR, NXG and after the bell JCG. Wednesday pre market AEO, PLCE, QLTI, and after the bell BLDP, FCEL, GYMB, HOTT, IPAR, JAS, MW, SMTC, WES. Thursday pre market ARIA, IMAX, NGPC, NPSP, GASS, and after the bell GG, NABI, NSM, PSUN, SEAC, SHFL, ZUMZ. Friday pre market ANN, KIRK, PEI and nothing after the bell.

COMPX (Nasdaq Composite) closed +34.04 at 2326.35. Support: 2277.60, 2247.48-2240.37 38.2%, 2226.04, 2186.83. Resistance: 2347.41, 2387.78, 2393.88, 2473.20 8/18 swing high, 2519.97