Friday closed the day down, the week marked the biggest loss since the week of January 31. Nervousness over the global financial pressures sparked some profit taking. Volume was split again today with the NYSE higher and the Nasdaq lower on the day. Thursday the NYSE was lighter and Nas higher. We are just seeing some rotation and nothing real consistent in this drop. However, the semiconductors (SOX) lost 4.54% on the day putting the weight on the Nasdaq. The TRIN closed at 2.20 and the VIX at 22.05, 20% off the 10dma. Gold closed up $12.20 to $1181 and oil up 98 cents to $86.15 a barrel.

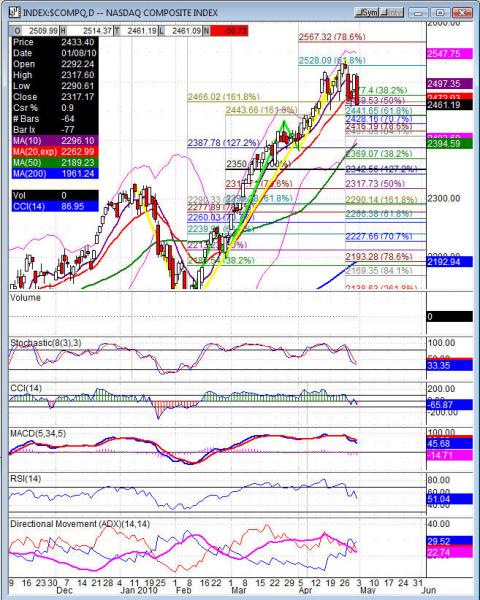

The weeks drop engulfed last week leaving a possible bearish engulfing pattern. CCI, RSI and Stochastics all closed down on the broader indexes. The drop also brought the weekly charts off the upper Bollinger band that we’ve been skating up for weeks. This was the biggest VIX move the market has seen since the week of January 31st. The Nas Composite, Nas 100, S&P 500 and Dow have all been trading on the years lows alternating days in a channel on the high but with no follow through on pullbacks. Friday marked the first close under the 10dma and 20dema since February on the indexes.

Nas Composite watch 2441.65-2416.19 support, Nas 100 1988.07-1968.68, SPX 1178.44-1167.20, and the Dow at 10932.70. With a drop like we saw on Friday the mid point on the day is now key resistance. Monday an early bounce is likely to come in with the TRIN over 2 and the VIX so extreme. That mid point is the key, if the market can’t retrace beyond that point we’ll look for continuation to the downside. The supports outlined above would provide a ledge for another move lower. If the Goldman probe continues and we keep seeing downgrades like Spain, Portugal, and Greece this week. This market may continue to show some nervousness and give us some correction. The week ahead will give us some insights into the Job’s numbers. The market needs to see improvement and will look to Wednesday to start seeing that data released.

Economic data for the week (underlined means more likely to be a mkt mover) Monday 8:30 Core PCE Price Index, 8:30 Personal Spending, 8:30 Personal Income, 10:00 ISM Manufacturing PMI, 10:00 Construction Spending, 10:00 ISM Manufacturing Prices, Total Vehicle Sales all day. Tuesday 10:00 Pending Home Sales, 10:00 Factory Orders. Wednesday 7:30 Challenger Job Cuts, 8:15 ADP Non Farm Employment Change, 10:00 ISM Non-Manufacturing PMI, 10:30 Crude Oil Inventories. Thursday 8:30 Unemployment Claims, 8:30 Prelim NonFarm Productivity, 8:30 Prelim Unit Labor Costs, 10:30 Natural Gas Storage. Friday 8:30 Non Farm Employment Change, 8:30 Unemployment Rate, 8:30 Average Hourly Earnings, 3:00 Consumer Credit.

Some earnings for the week (keep in mind companies can change last minute: Monday pre market DNDN, GAS, and after the bell APC, EOG, PFG, UTI, VOLC. Tuesday pre market ADM, BZH, BYD, COCO, CVS, DPZ, DUK, EE, HNT, MRO, MMC, MA, MRK, NYX, OSG, PFE, PNCL, SU, THC, TEVA, and after the bell ATML, CEPH, DLLR, ERTS, ESLR, IPI, JCOM, ONXX, TIE, TRLG, XL. Wednesday pre market AGU, DVN, GRMN, ICE, PHM, Q, TWX, UPL, WCG, XTO and after the bell BMC, CECO, ERES, GDP, JDSU, LVS, MCHP, MUR, NVEC, ONNN, PACR, PRU, QSFT, SMSI, RIG. Thursday pre market ATPG, FNM, FTO, MGM, OMG, OHI, QLTI, SLE, SKYW, and after the bell ADPT, AIG, BEBE, NILE, CEC, HANS, KFT, MRX, NVDA, TS, WTW. Friday pre market AES, CF, HUN, SUG, TTI and nothing after the bell.

COMPX (Nasdaq Composite) closed -50.73 at 2461.19. Support: 2441.65, 2416.19, 2394.59 50dma, 2369.07 38.2%. Resistance: 2518.29, 2535.28, 2549.94 6/1/8 swing high, 2617.29.