Wednesday closed the day modestly green across the broader markets. The range was very contracted digesting Tuesday’s big move. The SPX held just over Tuesday’s low, while the other indexes dropped that low and rebounded. Overall it was a very lackluster day, especially for a Fed day. The market also received more debt worries with a downgrade for Spain. The reaction was quick, but very limited, nothing like the floodgates Tuesday experienced with Greece and Portugal. The TRIN closed very bullish at .54 and the VIX left an inside day closing at 21.08. Volume was well off Tuesday’s pace, showing that lackluster range and participation. Gold closed up $11.00 to $1173.20 an ounce and oil closed up 78 cents to $83.32 a barrel.

The Fed left the rates 0% to .25% and didn’t deliver any surprises in the statement. I wonder if the news from Greece and Portugal yesterday changed their tone, we may see that when the minutes are released what the mindset was going into the meeting and if they made adjustments with the recent downgrades. After the bell PALM popped off the HPQ offer to acquire them, BIDU and FSLR were up off earnings. V, XLNX, ALL are all down off earnings. All of the movement left futures very quiet. The session may pick up steam as the European session gets underway. The Spain news came out just ahead of those markets closing, so they’ve had some time to start digesting it ahead of the opening.

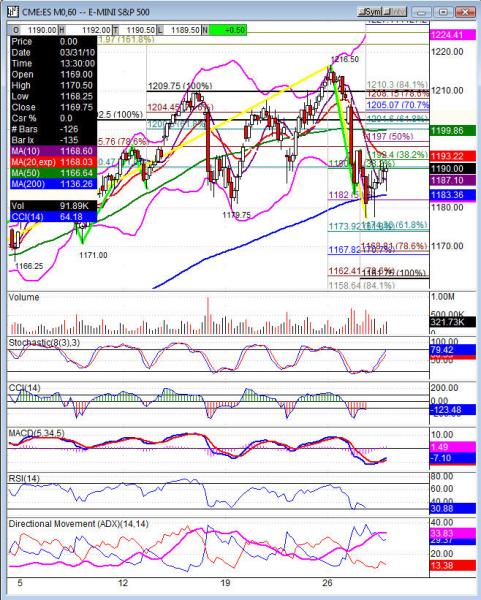

Thursday I expect to see some upside early to try to follow through off the late day move. The ES watch 1192.50, NQ 2015.50 and the TF 728.10 for resistance. Through those levels this dip will be the buying opportunity. The market sits at a key area and we’ve held this same spot off the fall on April 19th. If the market can’t clear the resistance I will look for new lows on the week. Dropping those April 19th swing lows will like result in several days of selling. To far and the market will erase April’s gains, the COMPX sits 88 points, NDX 63, SPX 21 and the Dow 188 points off the April low. That is nothing more than a few days of dropping if we get in motion. These narrow range up days are baby steps so it doesn’t take a lot to erase that.

Economic data for the week (underlined means more likely to be a mkt mover) Thursday 8:30 Unemployment Claims, 10:30 Natural Gas Storage. Friday 8:30 GDP, 8:30 Advanced GDP Price Index, 8:30 Employment Cost Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Thursday pre market AEP, BJS, BG, CAH, CELG, CME, COP, XOM, HP, HURN, IMAX, IP, K, MOT, MYL, GAS, NS, OMX, ZEUS, PTEN, POT, PG, HOT, TSM, WM, and after the bell AEM, HIG, KLAC, MXIM, MET, PDLI, QLGC, SUN, TSO. Friday pre market AGN, CVX, DHI, LPNT, NDAQ, VFC and nothing after the bell.

ES (S&P 500 e-mini) Thursday’s pivot 1186.75, weekly pivot 1202. Intraday support: 1182, 1179.50, 1174, 1171, 1167.75, 1164.50, 1161.25, 1156.50, 1147.75. Resistance: 1192.50, 1197, 1201.75, 1205, 1208.25, 1216.50