Wednesday a modest win for the broader markets on light volume. The Nas Composite and Nas 100 both traded just over Tuesday’s highs while the S&P 500 and Dow left inside days. Futures put in heavier volume than Tuesday, but the NYSE and Nasdaq indexes came in light. The A/D and U/D lines closed on the highs and the TRIN at .87. That TRIN is a little high although still considered bullish, but for a market that closed on its highs and held up well on the A/D and U/D lines that can be telling us the advancing stocks were buyers selling stock. Just a small “pink” flag to pay attention to and the other flag for us to pay attention to is the up days are not seeing that heavy volume for accumulation days. The VIX closed at 20.27 on the day. Gold fell $6.40 to $1096.80 and oil rose $1.06 to $79.93 a barrel.

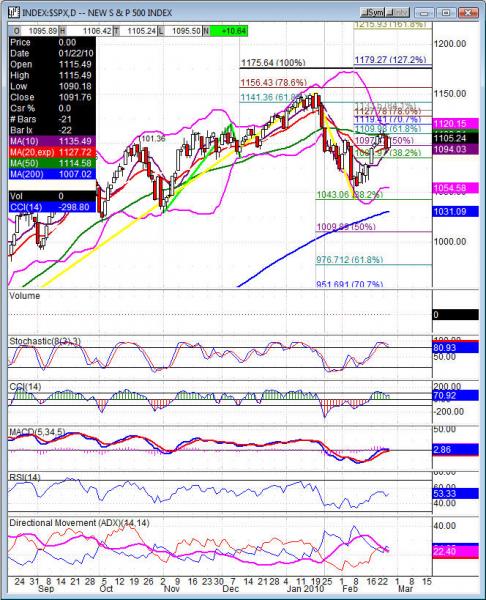

With the broader markets knocking at 61.8%’s resistance door and still unable to break through, we still sit under key resistance. The Dow 10388, SPX 1110, NDX 1827 and COMPX 2240 mark 61.8% resistance and the 50dma’s are in the same area. That door isn’t opening after five days of sitting just into that area. It makes for a big line in the sand for the market and until we see it break the bulls are on hold. The RSI, CCI are flat while the MACD and stochastics are turning downward. The longer the market sits here the more likely we are to see indicators on the daily charts flatten off and require a catalyst to break. A gap over the resistance with that catalyst would do it, or a pullback that is orderly to allow buyers to buy a dip or of course a big up day that powers through the line. But until one of those scenario’s push over the resistance we still look at any upside as an opportunity to pullback.

Economic data for the week (underlined means more likely to be a mkt mover): Thursday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Durable Goods Orders, 10:00 HPI m/m, 10:30 Natural Gas Storage. Friday 8:30 Prelim GDP, 8:30 Prelim GDP Price Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations, 10:00 Existing Home Sales.

Some earnings for the week (keep in mind companies can change last minute: Thursday pre market ABK, CSE, FTO, ITWO, MYL, NEM, ZEUS, OMG, ZLC and after the bell DECK, DRYS, ERES, GPS, TIE. Friday pre market BIOS, FRO, GAS, TTI and after the bell AES.

SPX (S&P 500) closed +10.64 at 1105.24. Support: 1086.47 38.2%, 1070.45, 1059.03. Resistance: 1108.91 50dma, 1119.41, 1127.78, 1150.45.