Wednesday brought us a split finish on the market on light volume. The Nasdaq 100 (NDX) and Nas Composite (COMPX) closed the day green while the S&P 500 (SPX) and the Dow closed red. Futures volume along with the NYSE and Nasdaq fell off today despite the tech participation the market found today. The TRIN closed at 1.70 bearish on the days high and the VIX closed at 21.60. Gold fell $6.00 to $1112 an ounce and oil fell 25 cents to $76.98 a barrel.

Hardware sector (HWI) and Internet (INX) sectors moved back into the 50dma a key resistance point for two sectors that have a large impact on the Nasdaq index. The SOX, Telecomm (XTC), Brokers (XBD) all still remain under the 50dma’s. Along with those key sectors we still have all the indexes (Dow, SPX, NDX, RUT, COMPX) under the 50dma’s but closing in on that key moving average. Moving averages are important because they are widely watched and can trigger programs and even just the simple bear bull barometer thinking.

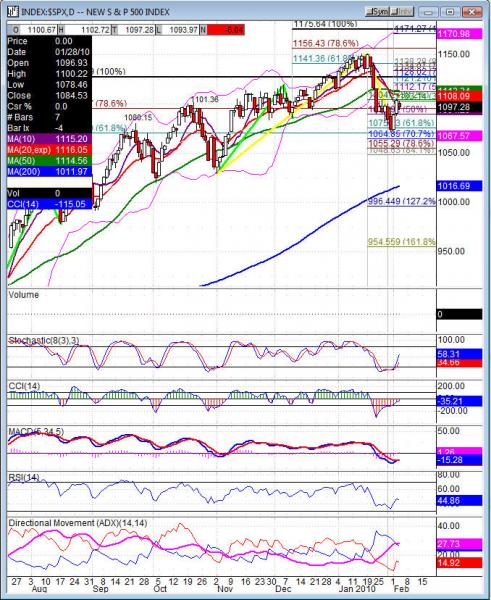

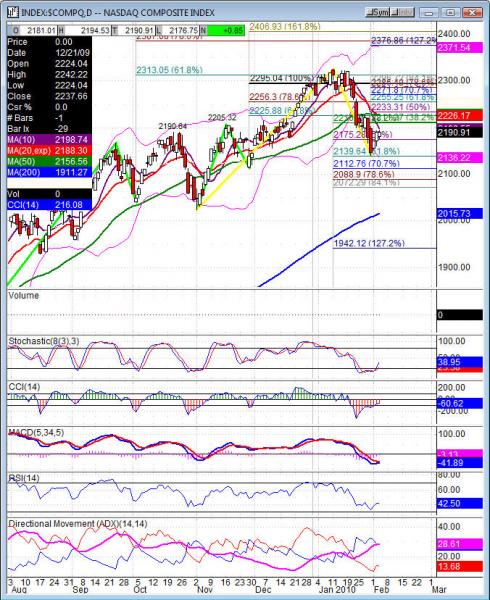

Fibonacci resistance at 38.2% is overhead at 10381.80 for the Dow, 1103.14 SPX (closed right into that resistance), 2211.37 COMPX, and the NDX at 1796.47. The day was a narrow range across the broader markets, but it was also an inside day for the SPX and Dow. An outside up day on the Nas 100 and Nas Composite, showing the strength in half the market and lacking in the other half. Yesterday I mentioned stochastics and the MACD for a cross up if we saw some upside today. Well the upside did close the MACD up and now the lines are converging for a cross up and stochastics even on the red indexes crossed up nicely. The RSI is turned up and the CCI is working closer to 0 line but still in negative territory. Technically speaking the market looks better with the Nasdaq’s advance today, but that TRIN along with the A/D and U/D lines concern me about that lift. It is a little suspect and when you see an advance with a bearish TRIN tone. That shows the advancing shares are being sold..which can be profit taking on long positions and it can be selling to enter a short position. Remember when you short you are selling the shares and you buy to cover it when you exit.

Leaving us a little weary into Thursday and I looked over earnings that came after the bell, most saw a nice reaction to the upside. Visa (V), Cisco (CSCO), Broadcom (BRCM) all up, YUM was lower with STLD also losing a little ground. Futures didn’t have a lot of reaction to even CSCO, which is the tone we’ve seen over the past week. I will still look for 38.2% to clear overhead for any upside lift to bring in participation. Until we clear that key level the market is trying to line up. The S&P was outpacing and well ahead of the Nasdaq after Tuesday and Wednesday chopped and churned the S&P for an inside day to let the Nasdaq advance. I call this an attempt to play catch up and get on the same page. That is a good sign, but Thursday and Friday the volume needs to increase and clear 38.2% or we’ll see the downside come in heavier than last weeks drop.

Economic data for the week (underlined means more likely to be a mkt mover): Thursday 8:30 Unemployment Claims, 8:30 Prelim Nonfarm Productivity, 8:30 Prelim Unit Labor Costs, 10:00 Factory Orders, 10:30 Natural Gas Storage. Friday 8:30 NonFarm Employment Change, 8:30 Unemployment Rate, 8:30 Average Hourly Earnings, G7 Meetings, 3:00 Consumer Credit m/m. Saturday G7 meetings continue.

Some earnings for the week (keep in mind companies can change last minute: Thursday pre market BCRX, BG, CI, CLX, CME, ITWO, K, MA, MF, PENN, PAS, SLE, SNE, HOT, and after the bell ATVI, MCHP, SUN, VARI. Friday pre market AET, BZH, BRKS, BZH, TSN, WY, YRCW and nothing after the bell.

COMPX (Nasdaq Composite) closed +.85 at 2190.91. Support: 2161.04, 2147.35 fills gap-2139.64 61.8%, 2088.90, 2024.27. Resistance: 2211.37-2228.87 50dma, 2286.49, 2326.28

SPX (S&P 500) closed -6.04 at 1097.28. Support: 1089, 1064.65, 1055.14, 1029.38. Resistance: 1113.34 50dma, 1134.07 78.6%, 1150.45.