Monday closed the day split with the NDX, COMPX, SPX all red, just modest losses and the Dow closed just a hair over the green line. Inside narrow range day was not anything to get excited about and left volume at the door too. Volume looked like a half day, just very light and no action pushing us around to get far. The TRIN closed at 1.53 bearish on the day and the VIX at 22.10. Gold closed down $5.80 to $1163.50 and oil down $1.53 to $73.94 a barrel.

Narrow range days are digestive and boring, they allow the market to sit and do nothing. Generally that comes after an exhaustive move or when the market expects something to come for a market moving event. The market isn’t expecting anything, this was digestive after Friday’s reversal day off the 2009 highs. Bracketing the range is what we need to do now and to see which side wins the tug of war. I said over the weekend to be cautious about the upside and still believe that until we see 2009 highs break out and not reject like we had on Friday the bulls are teetering on giving the bears the control.

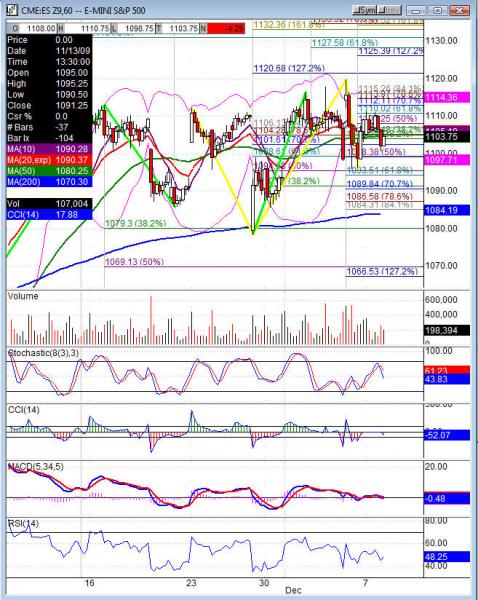

Futures opened on the weekly pivots and we saw that level several times throughout the day along with the daily. ES needs over 1114 before the bulls can get some momentum, a drop under1093.50 the bears will likely let us fall down into 1079.5. The NQ over 1800 is likely to move us into new highs on the year and under 1770.25 we are likely to fall into 1750.50.

Economic data for the week (underlined means more likely to be a mkt mover): Tuesday 10:00 IBD/TIPP Economic Optimism. Wednesday 10:00 Wholesale Inventories, 10:30 Crude Oil Inventories. Thursday Futures rollover, 8:30 Trade Balance, 8:30 Unemployment Claims, 10:30 Natural Gas Storage, 2:00 Federal Budget Balance. Friday 8:30 Core Retail Sales, 8:30 Retail Sales, 8:30 Import Prices, 9:55 Univ Of Michigan Consumer Sentiment, 9:55 UoM Inflation Expectations, 10:00 Business Inventories.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market AZO, HRB, KR, TLB, TTC and after the bell CKR, MW. Wednesday pre market MOV and after the bell FCEL, LULU. Thursday pre market COST, DG, UNFI and after the bell LTRE, NSM. Friday nothing of interest

ES (S&P 500 e-mini) Tuesday’s pivot 1104.75, weekly pivot 1104. Intraday support: 1098.25, 1093 fills gap, 1089.75, 1086.50, 1079.25 38.2%, 1074.50. Resistance: 1110, 1114, 1119-1120.75, 1125.50, 1130.25, 1134