Monday left an up inside day on the markets on light volume. Futures were about half of the volume the market brought to us on Friday, so it was a very dull narrow range day. The TRIN closed at .99 and the VIX at 25.41, also an inside day and still 21% off the 10dma. Which leaves us to watch for the 10dma to pull in closer while the market digests the move or see the VIX drop to meet up with the 10dma. Usually about 10% of away from the 10dma is something we watch for. Gold closed up $6.70 to $1096.40 and oil up 68 cents to $75.22 a barrel.

Inside days are digestive and a pause day to let the market work off conditions and slow things down. A break of the inside days range can help find the days primary direction. The range was so narrow it will not be hard to break and find movement for a trade or two. The only thing I want to be cautious of is Friday’s low, a break of Monday’s range will send us there quickly and that is support. If we can’t break that low limited downside is likely to be the tone of the day. Keep in mind Tuesday is day one of the FOMC meeting and that can slow things for awhile too. Chairman Bernanke’s second term confirmation is getting some support under it, but it isn’t a done deal still and that will continue to linger this week until it is done with.

Apple reported after the bell they put in a good quarter and traded down then back up over the closing price. Iphones came in lighter than expected, which shook the numbers and they’ve changed some accounting practices so that can cause confusion to know what is in the numbers and what isn’t. But overall it appears they had a very good quarter and trading up almost a percent. VMW also up on great earnings (18%), TXN down about 1.5% and that will put some drag on the SOX. Watch EMC in sympathy with VMW and until we hear from Apple on Wednesday about the “tablet” or whatever they will call it, we won’t have a clear picture on Apple.

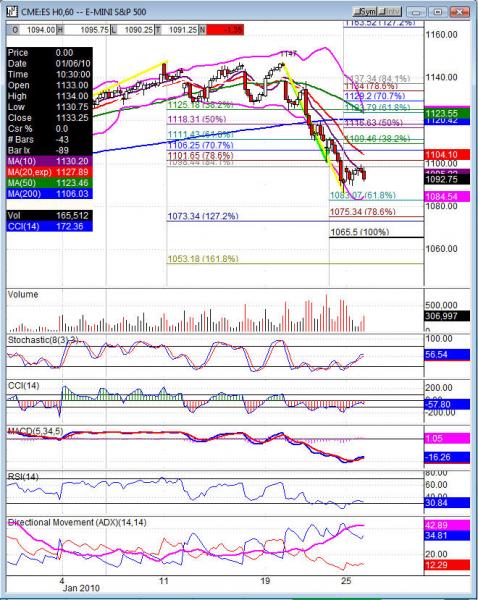

60 minute futures closed in a possible bear flag formation, which will be bearish for the market. That trigger would bring in volume and set the markets into that continuation mode. Futures did not test the weekly pivots today, but the ES spent most the day about its daily. The NQ only tested the daily once and the TF not at all. That leads us to look for those dailies to be in play tomorrow 1801 NQ, 1093.75 Es and 615.80 on the TF. Weekly are still above us at 1108.25 for the ES, 1827.50 NQ and TF 625.60. Those will require retracing almost 38.2% of this drop, which is a GREAT target for any bounces. When the 38.2% and weekly pivots are so close that convergence gives us a nice magnet and those targets are steep resistance levels. ES 38.2% is at 1109.5, NQ 1830 and TF 625.40.

Economic data for the week (underlined means more likely to be a mkt mover): Tuesday 9:00 S&P/CS Composite-20, 10:00 Consumer Confidence, 10:00 HPI m/m, 10:00 Richmond Manufacturing Index. Wednesday 10:00 New Home Sales, 10:30 Crude Oil Inventories, 2:15 FOMC Statement, 2:15 Federal Funds Rate. Thursday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Durable Goods Orders, 10:30 Natural Gas Storage. Friday 8:30 Advance GDP, 8:30 Advance GDP Price Index, 8:30 Employment Cost Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market GLW, DAL, DD, EMC, JNJ, NUE, TRV, X, VZ, and after the bell GILD, QLGC, RFMD, STLD, STM, SYK, WMS, YHOO. Wednesday pre market ABT, APU, BJS, BA, CAT, COP, DSPG, GD, HES, OSIS, UAUA, UTX, VLO, WLP and after the bell AMLN, BMC, ETFC, FLEX, ISIL, NFLX, NE, NSC, QCOM, RYL, JAVA, VAR. Thursday pre market MMM, ALK, MO, T, CP, CAH, CL, LLY, F, JBHT, JBLU, LLL, LMT, MOT, NOK, OXY, OSTK, POT, PG, TYC, UA, LCC, ZMH, and after the bell AMZN, AMCC, CA, DLLR, JNPR, KLAC, LSCC, MXIM, MSFT, PMCS, RMBS, SNDK, VSEA, YRCW. Friday pre market CVX, FO, HON, MAT, NS, and nothing after the bell.

ES (S&P 500 e-mini) Tuesday’s pivot 1093.75, weekly pivot 1108.25. Intraday support: 1089, 1086.25, 1084-1083, 1080.50, 1075.50, 1069.25 61.8%, 1065.50, 1058 70%, 1052.50, 1048 78.6%. Resistance: 1096, 1101.75, 1106, 1109.50 38.2%, 1111.75, 1116.75-1118.50, 1123.75, 1129.25, 1134