Monday closed the broader markets on the highs recovering most of Friday’s losses. The volume was very light though, the NYSE and Nasdaq had the lightest day in the last five trading days. Futures were about half of Friday’s volume, leaving us to look for participation to come in. The VIX closed at 20.19 after hitting the 200dma (22.08) the drop started and the VIX closed just off the days low. The TRIN spent most of the day at 1.12-1.18 and fell off to .92 at the close for a neutral reading. Gold closed up $1.50 to $1182.20 and oil up 4 cents to $86.49 a barrel.

The day left an inside candle and just under Fridays highs. That leaves the market in the same range it spent all of last week inside. Leaving us to need a break of last week’s range. Sounds easy enough, but don’t tell this stuck market that. The Greece news is still running through the market and how deep of a bailout this will end up being. There was no real mention of Goldman’s issues today and that let GS lift and get some relief today. Earnings will pick up steam now and economic data is heavy for the rest of the week. The market will start speculating on where Job’s will come in off the ADP data Wedsnesday morning, so we’ll look for some positioning late day Tuesday ahead of that.

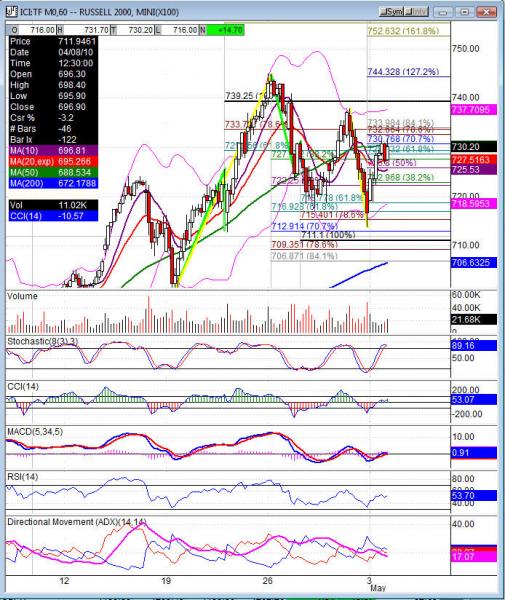

Futures did test the daily and weekly pivots today. We are also through the first day of the month, which has been a bullish day for the market and kept the trend in place today. The ES has 1216.75, NQ 2058.75 and TF 745 off last weeks high to look for. If we can’t push through that resistance this upside move today is nothing more than a relief bounce on very light volume. Which is how the day presented itself with the inside bar and very low volume. Until we see that high break and the market find that first continuation move the bulls are going to be in charge but with one foot out of the door for us. Es watch 1183.50-1182.75, NQ 2006.50 and TF 717.60 support, a break there and the bulls put two feet out the door.

Economic data for the week (underlined means more likely to be a mkt mover) Tuesday 10:00 Pending Home Sales, 10:00 Factory Orders. Wednesday 7:30 Challenger Job Cuts, 8:15 ADP Non Farm Employment Change, 10:00 ISM Non-Manufacturing PMI, 10:30 Crude Oil Inventories. Thursday 8:30 Unemployment Claims, 8:30 Prelim NonFarm Productivity, 8:30 Prelim Unit Labor Costs, 10:30 Natural Gas Storage. Friday 8:30 Non Farm Employment Change, 8:30 Unemployment Rate, 8:30 Average Hourly Earnings, 3:00 Consumer Credit.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market ADM, BZH, BYD, COCO, CVS, DPZ, DUK, EE, HNT, MRO, MMC, MA, MRK, NYX, OSG, PFE, PNCL, SU, THC, TEVA, and after the bell ATML, CEPH, DLLR, ERTS, ESLR, IPI, JCOM, ONXX, TIE, TRLG, XL. Wednesday pre market AGU, DVN, GRMN, ICE, PHM, Q, TWX, UPL, WCG, XTO and after the bell BMC, CECO, ERES, GDP, JDSU, LVS, MCHP, MUR, NVEC, ONNN, PACR, PRU, QSFT, SMSI, RIG. Thursday pre market ATPG, FNM, FTO, MGM, OMG, OHI, QLTI, SLE, SKYW, and after the bell ADPT, AIG, BEBE, NILE, CEC, HANS, KFT, MRX, NVDA, TS, WTW. Friday pre market AES, CF, HUN, SUG, TTI and nothing after the bell.

TF (Russell 2000 e-mini) Tuesday’s pivot 727, weekly pivot 725.20. Support: 724.90, 722.70, 720.60, 719, 717.60, 715.40, 712.90-712.30, 711.10, 709.30, 706.90, 705.50. Resistance: 730.80, 732.70-733, 734, 738.30, 740, 745