Monday started with a gap and go with strength moving the market up for 30 minutes and then we topped, but remained green although closed on the lows. Volume was very mixed with the NYSE and Nasdaq’s being lower than Fridays and Futures all came in higher than Friday’s. The VIX closed at 21.16 not far off the years lows at 20.10, today’s low was 20.90. The TRIN closed at .75 bullish on the day, but was well off the lows. Gold closed up $18.00 to $1164 and oil up 5 cents to $77.52 a barrel.

The market came off after the early strength, we still held the gap up action to hold green. The action was a little lackluster and there is a lot of hype to pay attention to in the dollar to gold direction still in the market. There is also a lot of talk about Thanksgiving weeks direction follows Monday. I don’t put a lot of credibility into that, we started strong and came off so how to gauge that into the rest of the week would be my question. I expect a weaker start on Tuesday unless the GDP pre market data can blow the market out of the water for the bulls to get another strong move. Otherwise an early pullback and then to see the market move back up would be what I am looking for in this holiday shortened week. Not rotating very far outside the range is still what I expect and with this big move up today that leaves the top side as possibly in for a retest and then rest until we get through Thanksgiving holiday. The 2009 highs are still just overhead and that can be our line in the sand to watch for overhead.

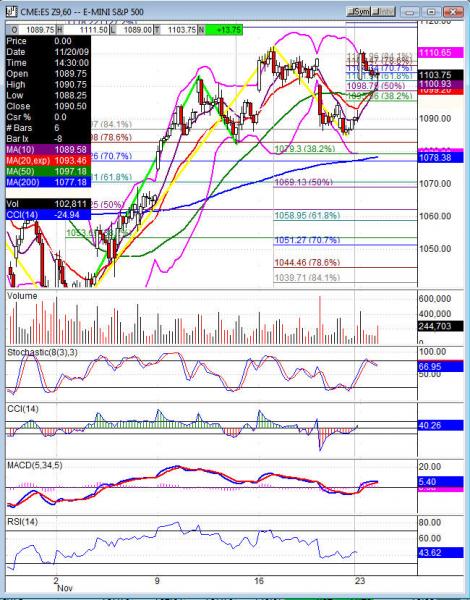

Futures traded outside R3 levels very quickly today, it is really unusual to trade outside those levels and not come back within them. Which is what we did today and still left the weekly pivots untested. Weekly pivots are below us and we didn’t even get a look at the daily today. That is also unusual and leaves Tuesday’s to be more important for movement around. Daily for the ES will be 1105.5 and weekly is down at 1095.5, that is where we look to head into Tuesday or Wednesday. I would like to see it on Tuesday and hold for support. However that would still leave the gap open down at 1090.25 to fill and be support.

Economic data for the week (underlined means more likely to be a mkt mover): Tuesday 8:30 Prelim GDP, 8:30 Prelim GDP Price Index, 9:00 S&P/CS Composite 20 HPI, 10:00 CB Consumer Confidence, 10:00 Richmond Manufacturing Index, 2:00 FOMC Meeting Minutes. Wednesday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Core PCE Price Index, 8:30 Durable Goods Orders, 8:30 Personal Spending, 8:30 Personal Income, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations, 10:00 New Home Sales, 10:30 Crude Oil Inventories, 12:00 Natural Gas Storage. Thursday US Markets are closed Happy Thanksgiving. Friday nothing due out.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market AEO, BKS, BRCD, DLTR, HNZ, MDT and after the bell JCG, TIVO. Wednesday pre market DE, TIF and after the bell ZLC. Thursday US markets are closed. Friday pre market FRO, SFL and nothing after the bell.

ES (S&P 500 e-mini) Tuesday’s pivot 1105.50, weekly pivot 1095.50. Intraday support: 1101.50, 1095.25, 1090.75-1090.25 fills gap, 1085.25, 1079.25 38.2%, 1074.50. Resistance: 1107.50, 1109.50, 1112.25 11/16 swing high, 1116, 1118.25, 1124, 1129.50