Tuesday the market gapped down, filled the gap, found resistance and turned around so slowly we almost fell asleep. However, the pace was slow but smooth so allowed us to stay short off that top all day. The market fought off the reversal and finally accelerated late day to bring in more participation. The volume was higher today than Monday on the NYSE, Nas and futures. The TRIN closed bearish at 1.27 and the VIX at 21.48 on the day. Gold fell $1.10 to $1122.70 and oil moved higher by $1.17 to $70.68 a barrel.

The Nasdaq composite was the only index to touch new highs for 2009 intraday, but did not close at new highs. The COMPX and the Russell 2000 (RUT) left a big shooting star on the day, NDX a spinning top, SPX and the Dow left an engulfing candle on the day. All the indexes excluding the NDX left possible reversal candles on the day AGAIN. We’ve seen that since Friday with hanging men which all lacked confirmation. This leaves us to wait to see if Wednesday confirms with a lower close on the day. Sectors again had the split, the SOX new highs on the year with a shooting star, HWI shooting star with a slightly lower swing high, INX still narrowing, XTC into the 10dma and lower end of the channel, BKX big ouch and nearing the 11/2 swing low, XBD are just off the 11/27 swing low with the drop today.

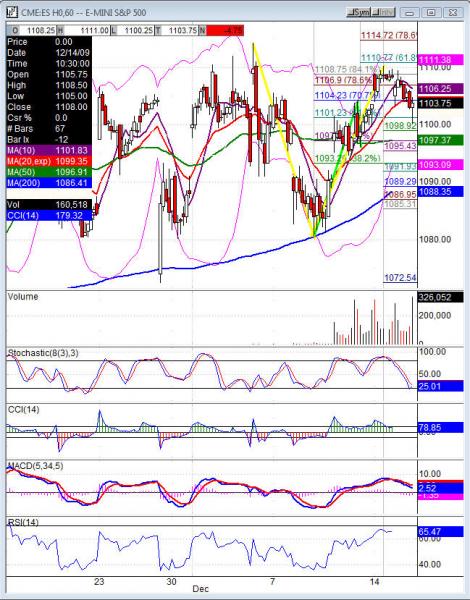

Having said ALL that and seeing the indicators still falling off with price. IF we did not have Fed tomorrow we would look for a continuation of this pullback. BUT we have all eyes on the Fed tomorrow afternoon. Early data on Wednesday could lead us to an active opening and into the first hour, after that things are likely to chop until the 2:15 announcement. Some retracement of the drop can be where we look to start the day, assuming the data comes close to consensus. With no surprises some retracement and then a possible retest of the lows to wait on the Fed could be in store for us. Futures did not test the weekly pivots yet, that is still below us, Tuesday did play off the daily several times after Monday not testing the daily. Any further downside won’t have a hard time getting to the weeklies.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 8:30 Building Permits, 8:30 Core CPI, 8:30 CPI, 8:30 Current Account, 8:30 Housing Starts, 10:30 Crude Inventories, 2:15 FOMC Statement and rate. Thursday 8:30 Unemployment Claims, 10:00 Philly Fed Manufacturing Index, 10:00 CB Leading Index, 10:30 Natural Gas Storage. Friday nothing due out, quadruple expiration day.

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market JOYG and after the bell APOG, HOV, OHB, PAYX. Thursday pre market DFS, FDX, GIS, PIR, RAD, SCHL and after the bell COMS, ACN, DRI, NKE, ORCL, PALM, RIMM, SCS. Friday pre market KMX, CCL and nothing after the bell.

ES (S&P 500 e-mini) Wednesday’s pivot 1104.50 weekly pivot 1096.50. Intraday support: 1099, 1095.50, 1092-1090.50 fills gap, 1087, 1084, 1080.50, 1072.50. Resistance: 1105.25, 1107.25, 1110.25, 1114.75, 1116, 1119.75, 1123.50-1125, 1128.25, 1134.25, 1135