Tuesday closed the market green on heavier volume for an accumulation day. Futures volume was a little lighter on the NQ and TF, but the ES was heavier. Again today the Nasdaq lagged the S&P 500 and the Dow. The TRIN closed at .65 bullish and the VIX at 21.48. Gold closed up $13.20 to $1118.20 an ounce and oil up $2.74 to $77.17 a barrel. The advance in commodities lifted the S&P 500 to outperform the Nasdaq, because we did have tech outperforming the financials today.

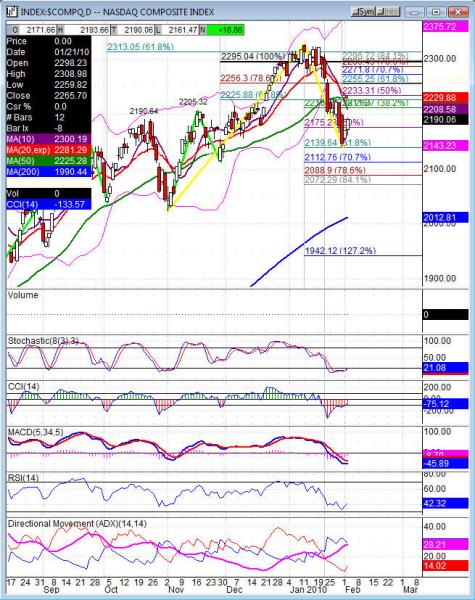

Daily charts on the COMPX, NDX, SPX and Dow are moving back up toward the 50dma, stochastics have flattened off, MACD is still open to the downside, RSI up to 42-46 and the CCI is over -100 working back up to 0 line. Another up day and the stochastics would cross up and likely to retest the 50dma. 38.2% is also overhead at 10381.80 for the Dow, 1103.14 SPX (closed right into that resistance), 2211.37 COMPX, and the NDX at 1796.47. All but the SPX have some room to move before hitting 38.2% and the 50dma is in the same area. The market did this to us last week (Wednesday) with and accumulation day and left us with two big days down to follow. So that leaves us to be cautiously optimistic about this advance and continuation.

Wednesday the day starts with early employment data and they continue into 10. The market will start to think about Friday’s Job’s data with us hearing from ADP Wednesday. ADP use to be really off from the Governments data, but lately they’ve been fairly inline and reliable. So discounting the data isn’t something we see any longer. Just take that with a grain of salt as we get into the data releases. With the Nasdaq lagging and the SPX into resistance, something has to give on Wednesday. Nasdaq has to step up or we’ll see selling step in and kill the rally. The SPX can’t lead day after day, so we have a small red flag out and watchful for the Nasdaq to catch up and test 38.2% resistance. Until then the upside is suspect and even the volume will have some work to continue.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 7:30 Challenger Job Cuts, 8:15 ADP Non Farm Employment Change, 10:00 ISM Non Manufacturing PMI, 10:30 Crude Oil Inventories. Thursday 8:30 Unemployment Claims, 8:30 Prelim Nonfarm Productivity, 8:30 Prelim Unit Labor Costs, 10:00 Factory Orders, 10:30 Natural Gas Storage. Friday 8:30 NonFarm Employment Change, 8:30 Unemployment Rate, 8:30 Average Hourly Earnings, G7 Meetings, 3:00 Consumer Credit m/m. Saturday G7 meetings continue.

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market ATMI, CMCSA, HNT, IP, ITG, NOV, PFE, RL, R, SGP, SLAB, TWX, TZOO, and after the bell NDN, AFFX, AKAM, BBBB, CELL, BRCM, CSCO, ONNN, OHB, SSTI, SPF, STLD, THQI, V, YUM. Thursday pre market BCRX, BG, CI, CLX, CME, ITWO, K, MA, MF, PENN, PAS, SLE, SNE, HOT, and after the bell ATVI, MCHP, SUN, VARI. Friday pre market AET, BZH, BRKS, BZH, TSN, WY, YRCW and nothing after the bell.