Tuesday’s range a little better than Monday’s but still a fairly quiet day. The day closed green for the Nas 100 (NDX) but red for the Dow, S&P 500, Nas Composite all on heavier volume. Futures volume increased today over Monday’s. The VIX closed at 24.55 still 15.5% off the 10dma, but made quick progress pulling off that 21% we saw Monday. I do like to see it within about 10% of the 10dma. The TRIN closed at 1.28 bearish on the day. Gold closed up $2.40 to $1098.10 an ounce and oil down 55 cents to $74.71 a barrel.

Wednesday will have several big events starting with pre market earnings and into data at 10. The FOMC will release a statement at 2:15 and throughout the day Treasury Secretary Geithner will be before the House Oversight and Reform committee. Apple to release the tablet, that could spark some tech movement. The President’s state of the union address will be held Wednesday evening. Busy day for the media and likely to cross over to the market with anything that the market likes or doesn’t like. However, look for a quiet tone ahead of the Fed.

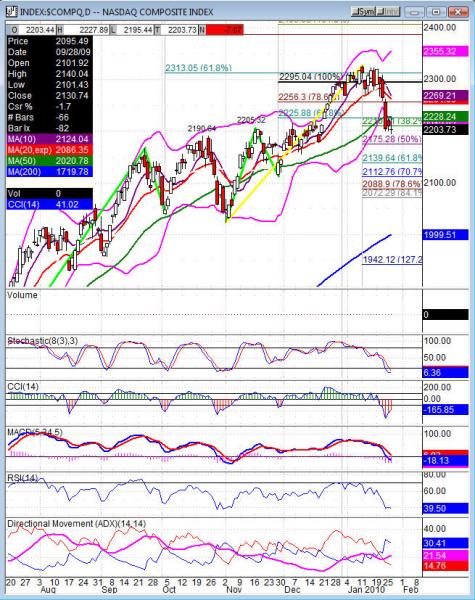

The market sits in a small consolidation after a big impulse down, this is day two of the consolidation. A bear flag would need at least three days of consolidation to form and then continue. The broader markets each have the same pattern and indicators all pretty equal With stochastics in single digits, that is oversold, RSI down at 35, CCI all rising and nearing that -100 line and a MACD still open to the downside. A rejection at -100 maybe the first sign of starting to come out of the flag if it finishes forming. Each index also sits just under the 50dma, snap back over it would turn things back up easy enough or we consolidate and flag to drop another leg.

Futures did not test the weekly pivots which are lined up near 38.2% of this drop as resistance. Shorter time frames on futures, the 13 minute charts are forming an inverted head and shoulders, the measured moves on each would be into that 38.2% area. So it is something to watch for still to continue some retracement. However, the weak close today isn’t fairing well for the bulls. A gap down maybe needed to see any bouncing at this point. Weekly pivots are 1108.25 for the ES, 1827.50 NQ and TF 625.60. When the 38.2% (ES 38.2% is at 1109.5, NQ 1830 and TF 625.40) and weekly pivots are so close that convergence gives us a nice magnet and those targets are steep resistance levels. If the NQ drops 1786.5 the downside won’t wait on the daily flag it will just continue without that pattern.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 10:00 New Home Sales, 10:30 Crude Oil Inventories, 2:15 FOMC Statement, 2:15 Federal Funds Rate. Thursday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Durable Goods Orders, 10:30 Natural Gas Storage. Friday 8:30 Advance GDP, 8:30 Advance GDP Price Index, 8:30 Employment Cost Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market ABT, APU, BJS, BA, CAT, COP, DSPG, GD, HES, OSIS, UAUA, UTX, VLO, WLP and after the bell AMLN, BMC, ETFC, FLEX, ISIL, NFLX, NE, NSC, QCOM, RYL, JAVA, VAR. Thursday pre market MMM, ALK, MO, T, CP, CAH, CL, LLY, F, JBHT, JBLU, LLL, LMT, MOT, NOK, OXY, OSTK, POT, PG, TYC, UA, LCC, ZMH, and after the bell AMZN, AMCC, CA, DLLR, JNPR, KLAC, LSCC, MXIM, MSFT, PMCS, RMBS, SNDK, VSEA, YRCW. Friday pre market CVX, FO, HON, MAT, NS, and nothing after the bell.

COMPX (Nasdaq Composite) closed -7.07 at 2203.73. Support: 2175.28, 2139.64, 2088.90, 2024.27. Resistance: 2228.24 50dma, 2245.42, 2276.30, 2298.28, 2393.88 70.7%.