Tuesday brought a strong day for the broader markets on heavier volume. A kick off of earnings season brought in participation for the accumulation day. The TRIN closed at .43 very bullish and the VIX tested and held the 200dma (23.44) with a close at 24.56. Gold closed the day up $15.10 to $1213.80 and oil up $2.20 to $77.15 a barrel. Broader participation left the market closing just off the highs.

The Nas Composite, Nas 100 and S&P 500 closed right into 38.2% resistance we’ve watched all week for a test of resistance. The 50dma and 200dma are all right in this same zone on those indexes. The Dow cleared 38.2% and the 50dma, leaving the 200dma just at the days close. Internets, banks and brokers were the top three sectors and the bottom were telecom, hardware and healthcare. Semi’s fell in the middle of the pack on the day. Financials were barely outpaced by internets, which I believe helped hold the Nasdaq today and that late day pop helped balance the advance. The Nas 100 (NDX) was the weakest of the indexes with the Russell 2000 as the strongest. Strength led by financials and small caps is rarely sustainable, so we’ll see if the strength holds into Wednesday.

After the bell Intel (INTC) reported earnings and rallied the stock as well as tech. Futures are up nicely in the afterhours thanks to the INTC’s report. YUM Brands (YUM) reported and fell in the afterhours session. Now seeing the market hold the gains will be key into Wednesday. With the NDX, COMPX and SPX right into resistance the market may need to come off a strong opening to find some buyers on a retracement to sustain the rally. Gapping day after day starts to wear its welcome out after a few days. Leaving the market overbought and ready for retracement. Today closed the 6th consecutive day to the upside, that also wears on the market and hurts participation, everyone is afraid of buying a top as the market hits key resistance.

Futures did not test the daily pivots today. The weekly are still untested and today’s advance left more room to fall for a test there. The range expansion today left for better action than we saw on Monday, but the ES and NQ were not on the same page for much of the day. That was the tech and financials split on the day keeping us on two pages. Now into Wednesday we will see a very awake tech market off the INTC report and financials will start to look to Thursday to hear from JPM. Which leaves us to look for rotation and some pullback early in the day off a big opening.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 8:30 Core Retail Sales, 8:30 Retail Sales, 8:30 Import Prices, 10:00 Business Inventories, 10:30 Crude Oil Inventories, 2:00 FOMC Meeting Minutes. Thursday 8:30 PPI, 8:30 Unemployment Claims, 8:30 Core PPI, 8:30 Empire State Manufacturing Index, 9:15 Industrial Production m/m, 10:00 Fed Chairman Nomination vote, 10:00 Philly Fed Manufacturing Index, 10:30 Natural Gas Storage, Tentative Treasury Currency Report. Friday 8:30 Core CPI, 8:30 CPI, 9:00 TIC Long Term Purchase, 9:55 Prelim UoM Consumer Sentiment, 9:55 Prelim UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market ASML, TXI and after the bell LSTR, MAR. Thursday pre market SCHW, FCS, JPM, MTG, NVS, PPG and after the bell AMD, GOOG, JBHT, PLCM, NCTY. Friday pre market BAC, C, GE, MAT, and nothing after the bell.

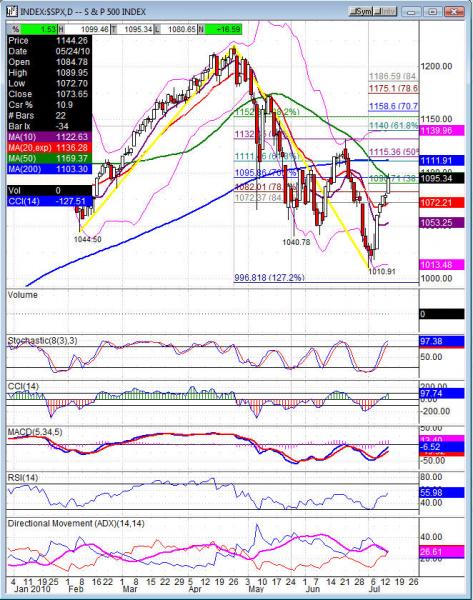

SPX (S&P 500) closed +16.59 at 1095.34. Support: 1083.71, 1065.44, 1044.41, 1029.45. Resistance: 1111.91 200dma-1115.36, 1131.23, 1140.