Tuesday started the week with a very small gain on the day. The day lost steam and gave up large gains off the gap, but managed to keep on the green side of the fence. Volume increased over Friday’s lackluster holiday volume to leave an accumulation day. The TRIN closed at .80 bullish and the VIX at 29.65, the first day under the 10dma in 8 days. Gold closed down $14.90 to $1192.80 an ounce and oil closed down 16 cents to $71.98 a barrel.

The day’s strong opening held up for half the day but started to lose ground into lunch and continued falling until the late day bounce to help hold onto gains. The last 40 minutes bouncing the market off the lows and into green looked to be some shorts covering. The market is still holding onto last weeks range and today’s modest gain will disappear quickly if the bears keep stepping into any strength. Shorting every move up is what we are seeing, but the end of day move up did show some short covering. Last week did not have short covering after big moves down, so that is a small tone change.

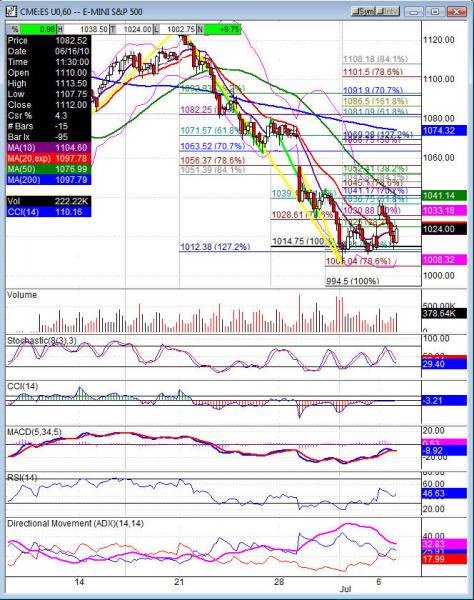

The key support COMPX 2050.23, NDX 1667.82, SPX 1006.99, and the Dow 9396.61 is 38.2% support off the March 2009 lows to the April highs is still the key area’s to watch for under us. Futures did test the daily and weekly pivots today getting those weekly out of the way quickly. The ES under 1013 would leave us to 1000 and even onto 994.50. The ES back over 1036.75 we can look for 1052.5 to test.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday nothing due out. Thursday 8:30 Unemployment Claims, 10:30 Natural Gas Storage, 11:00 Crude Oil Inventories, 3:00 Consumer Credit. Friday 10:00 Wholesale Inventories.

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market FDO and after the bell WDFC. Thursday pre market COMS, HELE, ISCA and after the bell LWSN, NUHC. Friday pre market PSMT and nothing after the bell.

ES (S&P 500 e-mini) Wednesday’s pivot 1025.50, weekly pivot 1033.50. Intraday support: 1015.50, 1013, 1010.75, 1006-1005.25, 1000.25, 994.50. Resistance: 1025, 1029, 1033.25, 1036.75, 1041.25, 1045, 1052.50, 1055.75, 1062.75, 1067.50, 1071.