Tuesday closed the day very red across the broader markets after starting with some strength the market faded into a trend day. Volume came in heavier on the NYSE and Nasdaq for a distribution day. The TRIN closed the day at 2.55 very bearish on the day and the VIX at 33.55. Gold fell $13.10 to $1215 an ounce and oil down 67 cents to $69.41 a barrel.

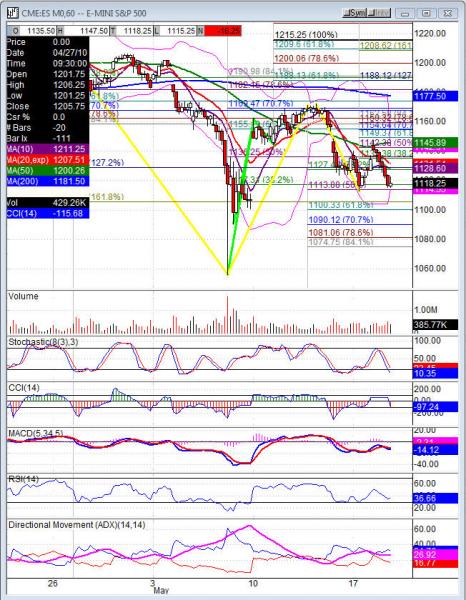

The drop once again came with a distribution day attached to it that is our 4th in the month of May versus one accumulation day in the month. Futures did test the weekly pivots today and fell off them. That clears that up on the week. With Friday’s drop, Mondays modest rise and today’s drop we are still sitting over the May 7ths gap support. This chop down did spread the ma’s out though separating the 10dma, 20dema and 50dma leaving the bears still holding order. Stochastics on the daily are trying to cross down, CCI is sitting negative and RSI is 38-40 area on each index. Now the market has to find continuation off this fall. Monday we were looking for the reversal candles to confirm on Tuesday, that didn’t happen. However we did not close under Tuesday’s low. Which means the market could still move up off this support on the weeks lows.

Into Wednesday the data is picking up early morning to get the day started. Along with that the TRIN close over 2 should help to produce an early bounce. Now Monday that didn’t come in the TRIN over 2 setup failed us. That is rare and we still look for an early bounce and some retracement of the day’s losses. A move to 1127.5 ES, 1896.25 NQ and 690 TF should be watched carefully. If we can’t clear that resistance we are likely to see continuation of this fall and get the week a new low. If we climb over look for a bigger move up and the market may keep us trapped in the range on the week. It isn’t a bad range so that isn’t necessarily a bad thing, it is just an observation.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 8:30 CPI, 8:30 Core CPI, 10:30 Crude Oil Inventories, 12:00 ECB President Trichet Speaks, 2:00 FOMC Meeting Minutes. Thursday 8:30 Unemployment Claims, 10:00 Philly Fed Manufacturing Index, 10:00 CB Leading Index, 10:30 Natural Gas Storage, Friday 7:00pm FOMC Member Dudley Speaks

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market BJ, DE, and after the bell AMAT, ADSK, HOTT, KONG, NTES, PETM, SNPS. Thursday pre market PLCE, CSC, DLTR, GME, ROST, SPLS, TGT, TTC, WSM, and after the bell BRCD, DELL, GPS, INTU, MRVL, SHLD, SKIL, WTSLA. Friday pre market ANN, HIBB and nothing after the bell.