Tuesday closed the market with a modest loss on the Nas Composite and Dow, the S&P 500 along with the Nas 100 closed green. Although the day looks modest for the loss and gain, the days range was very large and a big reversal day. Closing on the days highs after being blood red on a very weak opening is a big day. The TRIN closed at .47 very bullish and the VIX at 34.61 just over the 34.20 10dma. Gold closed the day up $3.80 to $1197.80 and oil fell $1.46 to $68.75 a barrel.

The weak opening left the day looking for buyers on a big dip. It took the market a few running starts to get moving and it did take the full day to fill the gaps. However, that does show the bulls stepped in and the accumulation day on the SPX and NDX do show participation and the COMPX and Dow just missed the green close. The daily candles are nice support candles and possible reversal candles. Keep in mind we had that on Friday and that didn’t confirm, so we need an up day to follow this move to confirm and give the market some confidence. Today’s shake was off more European concerns and South Korea, that market now can digest this and try to advance.

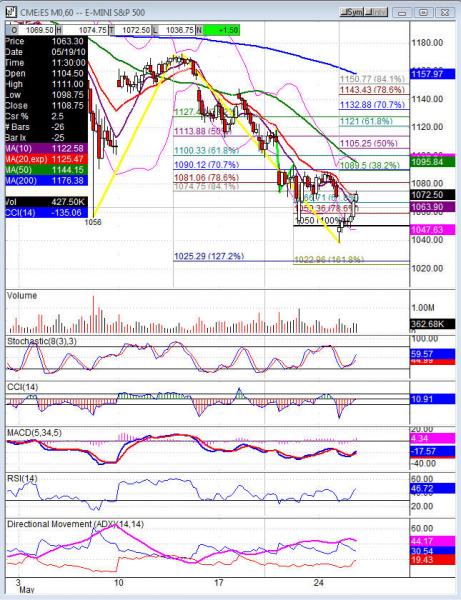

The weak opening brought the market to very oversold levels and the day could be an oversold bounce and not confirm. The volume was steady throughout the day and the drop of last weeks low and to snap back in range is a good sign that it is more than shorts covering. A gap up on Wednesday could lead to a gap and go move, don’t be quick to fade the move. If it sets up for us to fade we will, but the buying could come in and hold the gains. The daily pivots on futures did not test, that leads us to look for the PP to be more of a magnet into Wednesday. That would require a drop back into Tuesdays range and not let the market run to the upside with a pullback.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 8:30 Core Durable Goods Orders, 8:30 Durable Goods Orders, 10:00 New Home Sales, 10:30 Crude Oil Inventories. Thursday 8:30 Prelim GDP, 8:30 Unemployment Claims, 8:30 Prelim GDP Price Index, 10:30 Natural Gas Storage. Friday 8:30 Core PCE Price Index, 8:30 Personal Income, 8:30 Personal Spending, 9:45 Chicago PMI, 9:55 Revised Consumer Sentiment, 9:55 UofM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market AEO, FRED, TOL, ZLC and after the bell DBRN, HOKU, NTAP, TTWO, PAY. Thursday pre market BIG, COST, HNZ, SNSS, TIF and after the bell ESL, JCG, OVTI, SEAC. Friday pre market FRO and after the bell NCTY.

ES (S&P 500 e-mini) Wednesday’s pivot 1062, weekly pivot 1094.50. Intraday support: 1061, 1056.50, 1052.25, 1049, 1046.25, 1044.25, 1038.50. Resistance: 1077.50, 1082, 1085, 1089.50, 1093.75, 1098.75, 1104, 1110 fills gap-1111.75, 1118.25