Tuesday the market had a small loss across the broader markets. Volume showed the narrow range chop and came in mixed across the board. The NYSE was less than Monday,s Nasdaq was pretty equal to Monday’s and only the ES outpaced yesterday’s on futures. Very moderate day for the market to hold neutral territory in range. The TRIN closed at 1.04 and the VIX at 20.42 on the day, just over the 20.10 low on the year. Gold closed up 2.00 to $1166.80 and oil up 58 cents to $76.10 a barrel.

This lackluster movement is anything but exciting or inspirational for traders. However, that is a normal holiday week, no rush to do anything or find conviction on either side of this market. Nasdaq Composite 2129.97, Nas 100 1734.40, S&P 500 1072.55, and the Dow 9953.26 for the 50dma will be support below us. The Dow has a lot of room the other indexes are nearing those levels of support. The Russell 2000 is just overhead at 598.09 for resistance. Support is nearby and resistance is also nearing from the 2009 highs Russell 2000 625.31, Nas Composite 2205.32, Nas 100 1814.25, SPX 1113.69 and Dow at 10495.61 for the years highs. Having given the bigger support and resistance levels which is not a wide range, but I’m still not expecting the market to break the range in place this week. That leaves us to look for a narrow range and remain very neutral on the market conditions until after the holiday.

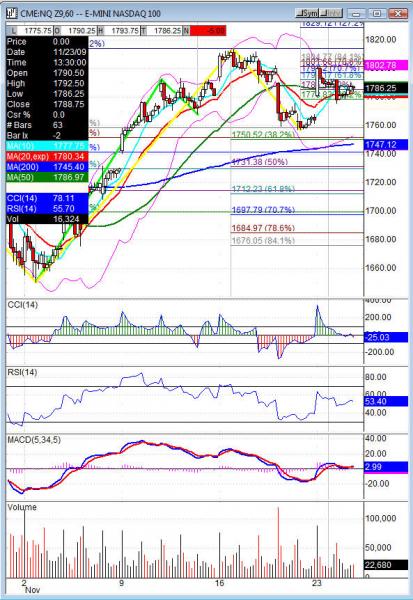

Futures did test the daily and weekly pivots and left the 60 minute charts in a triangle. Higher lows and lower highs are just forming a triangle in this range the market is sitting in. There is early data to kick off the day Wednesday and into 10 additional releases. All the data Wednesday can be market moving and will help to set the days tone. Although that tone maybe muted and range bound, we’ll look for just enough movement to find some nuggets to end our week.

Economic data for the week (underlined means more likely to be a mkt mover): Wednesday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Core PCE Price Index, 8:30 Durable Goods Orders, 8:30 Personal Spending, 8:30 Personal Income, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations, 10:00 New Home Sales, 10:30 Crude Oil Inventories, 12:00 Natural Gas Storage. Thursday US Markets are closed Happy Thanksgiving. Friday nothing due out.

NQ (Nas 100 e-mini) Wednesday’s pivot 1785, weekly pivot 1777.50. Support: 1784.50, 1779.25, 1774, 1766.75-1764 fills 11/20 gap, 1757.25, 1750.50, 1745.25, 1740.75, 1734.25, 1731.25-1729.75 fills gap. Resistance: 1792.25, 1801.50, 1808.25 fills gap 11/17, 1813.75 11/16 swing high, 1817.25, 1822.50, 1828.50, 1834-1836