While many believe when this entire fiscal cliff is settled the markets will be able to relax, I’m looking at something different. A volatile market may be headed our way and we owe it to the options market.

Open interest is an important component to predicting movement and range into an expiration. In December we not only have big open interest in SPDR S&P 500 ETF (SPY), Powershares Nasdaq ETF (QQQ) and iShares Russell 2000 ETF (IWM) strikes but we have more expiration days than expected. In fact, a rare occasion – the 28th and 31st will bring us consecutive expiration days on these and a few others as weeklies and quarterlies will expire. What does it mean? Well simply put the very high open interest has created a seller’s paradise – that is if there is no volatility.

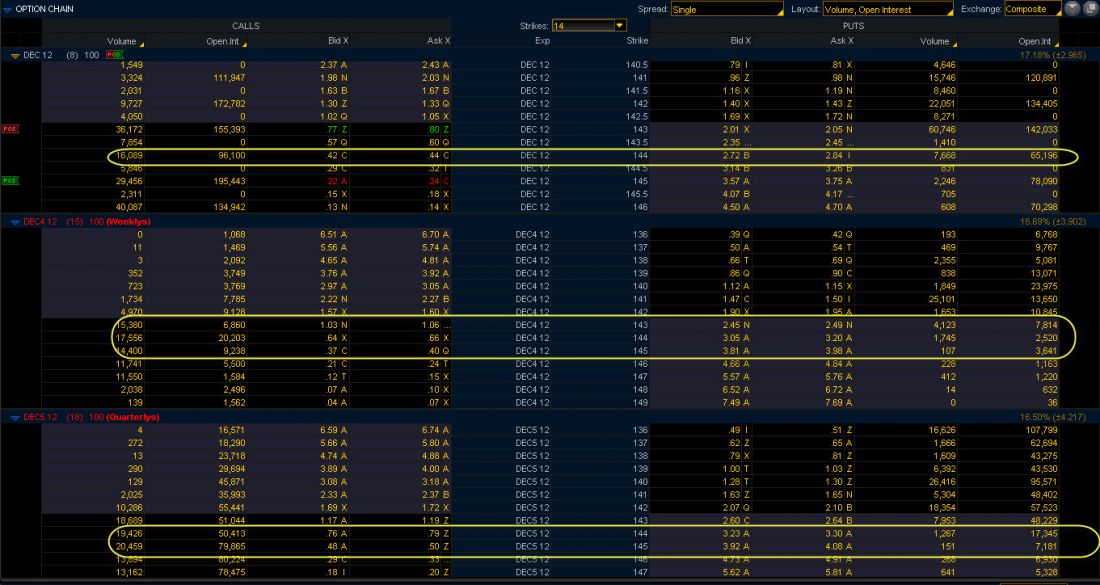

A seller of premium looks for little to no movement, preferring to let the time decay work in his favor. As open interest builds we find price attracts like a magnet to those particular strikes. Now, take a look at the montage below, which shows a skew toward call open interest on the quarterlies, heavier puts on the weeklies and a more even skew on the regular December options.

The read here is of balance in open interest and the 144 strike acting as the magnet. But within the two plus weeks remaining we’ll see some movement as the buyers and sellers jockey for position. While the VIX still tells us not to expect much volatility nor extreme moves we could see a big disruption, especially if some news trumps all else.

[Editor’s note: What’s your favorite options strategy right now? Or do you have a question for Options Guru Bob Lang? Leave a question below. Watch his recent CME Trading Floor Video here.]

= = =

Top Stories:

What Washington Isn’t Saying About Our Debt

Driving and Trading: Musings Behind the Wheel

Personal Finance: