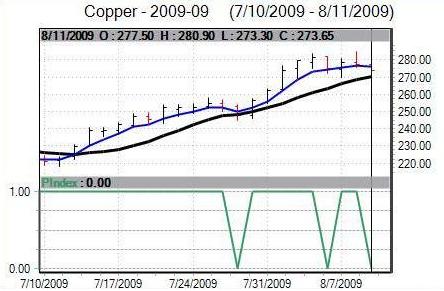

Copper Demand Affects Prices

Source: VantagePoint Intermarket Analysis Software

To see more FREE recent market predictions for metals go here!

The market increased by 47.65 dollars.

47.65 dollars = 11,912.50 USD per contract (About 19 trading days)

When the blue line (forecast) crossed above the black line (actual), VantagePoint predicted the market to trend up. The Neural Index at 1.00 also indicated an expected up trend.

Copper prices have soared 96 percent this year, partly because of surging imports by China, the world’s biggest metal user.

China’s imports of copper and the metal’s products in July dropped for the first time in six months, declining from a record, after stockpiles increased in the world’s largest consumer.