EUR/USD

The Euro stalled in the 1.3180 area against the dollar on Monday and was subjected to renewed selling pressure in US trading with a retreat to test support below the 1.31 level. Technically, the Euro also dipped to just below the 200-day moving average.

The currency was unsettled by further fears surrounding the structural weaknesses as Moody’s downgraded the credit ratings for several Spanish banks. There were persistent fears that countries such as Portugal would face major difficulties in raising funds early next year which would make it very difficult to avoid another EU support package. There were further fears that the Irish banking-sector support would compromise ECB operations.

Overall confidence in the US growth outlook remained slightly stronger and Regional Fed President Bullard stated that the Fed’s quantitative easing programme could be adjusted during the course of 2011 which provided tentative dollar support.

The Euro found support below 1.31 and rallied in Asian trading on Tuesday following comments by Chinese Vice Premier Wang that China had taken concrete steps to support the European Union with its debt problems. There will be speculation of increased buying of Euro-denominated bonds which would certainly ease financing difficulties and the Euro rallied to a high near 1.3195. Choppy trading conditions will remain an important risk as liquidity declines ahead of the Christmas and New Year period.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to secure a renewed advance against the yen on Monday and retreated to test support just below 83.60. The US currency was unsettled by a small decline in US bond yields while there was also evidence of exporter selling.

There will be the potential for capital repatriation before the year-end period which will also provide some underlying support for the Japanese currency, especially with reduced liquidity.

As expected, the Bank of Japan left interest rates on hold in the 0.00 – 0.010% range at the latest policy meeting and there were no fresh policy announcements. The central bank downgraded its growth expectations and there will be pressure for a highly-expansionary monetary policy to continue which will limit yen support, but the dollar was unable to gain any traction following the Bank of Japan decision.

Sterling

Sterling was unable to regain the 1.5580 level against the dollar on Monday and drifted weaker to re-test support close to 1.5480 as there was renewed demand for the dollar. The UK currency edged stronger against the Euro before finding resistance close to 0.8450.

The GfK reading of consumer confidence was unchanged for December which may provide some degree of relief, but there will still be expectations of a sharp economic slowdown in the first quarter of 2011 as consumer spending comes under renewed pressure. The latest mortgage lending data remained weak and there will be expectations of further housing-sector weakness in 2011 which will tend to undermine Sterling support.

Euro-zone events will continue to have a mixed impact as Sterling will gain some relief if there is an easing of contagion fears. Overall confidence in the UK banking sector is still likely to be fragile which will limit currency support and may emerge as a key issue during 2011.

Swiss franc

The dollar was unable to re-test resistance above 0.97 against the franc on Monday and drifted weaker to the 0.9620 area. The Swiss currency remained very firm on the crosses as it pushed to a fresh record high beyond 1.2650 before a retracement.

Underlying Euro-zone stresses will remain very important in the short term and there will be further defensive franc support as Euro-zone fears persist. The pledge of Chinese support for Euro debt will tend to dampen immediate franc demand, but tensions could return quickly.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

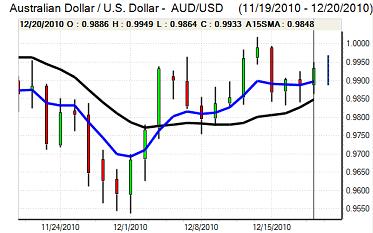

Australian dollar

The Australian dollar resisted a further test of support below 0.9850 against the US currency on Monday and gradually strengthened to the 0.9920 area. Domestically, the Reserve Bank of Australia minutes confirmed that the bank had a mildly restrictive policy, but there were concerns over the consumer spending outlook which will dampen Australian dollar buying support.

The currency gained further support from the Euro’s advance in Asian trading on Tuesday and strengthened to a high just above 0.9960 against the US currency as choppy trading conditions persisted.