EUR/USD

The Euro was blocked just above 1.38 against the dollar on Thursday and drifted weaker ahead of key economic events. As expected, the ECB left interest rates on hold at 1.00% ensuring that the press conference was the main focus.

President Trichet did point to short-term inflation risks, but he also stated that the medium-term risks were broadly balanced and that expectations were firmly anchored. The comments certainly dampened speculation over a near-term increase in interest rates which also put downward pressure on the Euro with Trichet pointedly moving away from an overtly hawkish tone. He also reiterated that the bank would wait for the new ECB staff projections in March and any substantial upgrading for the inflation forecasts would renew pressure for higher interest rates.

There was disappointment surrounding the latest Spanish bond auction which also undermined the Euro. The Friday EU summit will be watched closely and a show of unity would tend to provide some Euro support.

The US economic data was significantly stronger than expected with initial jobless claims declining to 415,000 in the latest week from a revised 457,000 previously while the ISM services-sector index also rallied to 59.4 from 57.1. The data will reinforce optimism over firmer growth conditions and there will be further optimism if there is a higher than expected employment figure released on Friday.

Fed Chairman Bernanke was more optimistic over economic conditions, but he also stated that the economy was still in a deep hole. Given the focus on employment, there will still be strong near-term resistance to higher short-term rates. The dollar will still gain some support if there is a further increase in long-term rates and the Euro weakened to lows just above 1.36 in Asian trading on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 81.50 against the yen on Thursday and rallied strongly to test resistance above 82 following the US data releases. The US currency was unable to sustain the gains and weakened back to test support below 81.50 later in the New York session.

The dollar will still be in a position to gain support on a rise in US Treasury yields, especially if there is a robust employment report on Friday.

The yen is still proving to be surprisingly resilient in the face of weak fundamentals. The currency will gain support if emerging-market tensions increase, but there has also been evidence of capital inflows into the bond market which will provide support.

Sterling

Sterling held firm ahead of the UK data releases on Thursday and jumped higher as the ISM services-sector index rose to 54.5 for January from 49.7 the previous month and all three PMI surveys were stronger than expected this month.

With inflation components also strong, there will be renewed pressure on the Bank of England to increase interest rates. This will tend to support Sterling, but there will still be doubts whether the economy will be robust enough to cope with higher borrowing costs. There will also be speculation that the central bank will lose control of inflation expectations which would undermine medium-term Sterling confidence. Former MPC member Barker warned over such a possibility in comments on Thursday.

Sentiment is still liable to fluctuate sharply over the next few weeks as the growth and inflation debate continues. From a peak above 1.6260 against the dollar, Sterling weakened to lows near 1.6120 as the Euro also lost ground, but Sterling held firm on the crosses.

Swiss franc

The Euro tested resistance above 1.30 against the franc on Thursday, but was unable to sustain a move above this level and weakened back to below 1.29. The dollar was buffeted by Euro volatility and after a brief spike above the 0.95 level, retreated to the 0.9425 area.

Reduced expectations of an ECB move to higher interest rates will tend to lessen any near-term selling pressure on the Swiss franc, although there will also be expectations that the National Bank will delay any move to raise borrowing costs.

Emerging-market tensions will need to be watched closely as any escalation in fears could trigger a renewed round of safe-haven franc demand.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

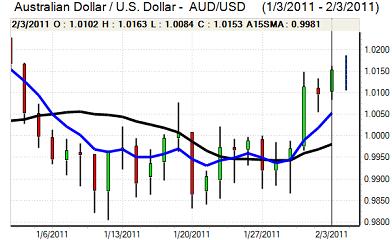

The Australian dollar was blocked in the 1.0150 area against the US currency during Thursday, but found good support below 1.01 and was generally resilient in the face of a firm US unit.

This strength was reflected in Asian trading on Friday with fresh gains to a high near 1.0190. The Australian currency gained support from high commodity prices and strong yields with the Reserve Bank generally upbeat over growth prospects, but there will still be concerns that any deterioration in risk appetite could trigger a rapid reversal in conditions.