The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Thursday, May 27, 2010

Hours of daily research consolidated for you

Disoriented?

It is 3:48am in Seattle as I begin and the Dow futures are 200 points, the DAX and FTSE are up well over 100, the CAC is up sharply and Asia had a nice rally preceding all this.

Arrived here at 9:30pm, Tuesday, baggage, travel to son’s, thrilled to see grandchildren…in bed at midnight (3am EST)…up to begin..can’t get computer to work, can’t get the tvs to work, so given the market’s reversal down on Tuesday this was hard on the nerves..wife Carmen gets up a few minutes later…5:30am pst..can’t find her purse with CCs, etc…SUV son picked us up in locked, can’t see inside..20 minutes later after making lists of who to notify..find keys..find purse..whew…people getting up, find the remote combos, find the passwords to their computers..daughter-in-law’s brother drops in with son…computer master whiz techie guy..sets me up in 45 seconds..now adjusting to time zones, etc…and trying to figure what will happen on the projects I am here to help with..

All that turmoil pales next to the European patient who is seeing two doctors that seem to have different diagnosis…Dr. Feelgood says everything is getting better or that, at least, the ECU will live and maybe walk again and Dr. Evil who says that not only will the Euro die, it will spread the financial bubonic plague around the world and everyone will die.

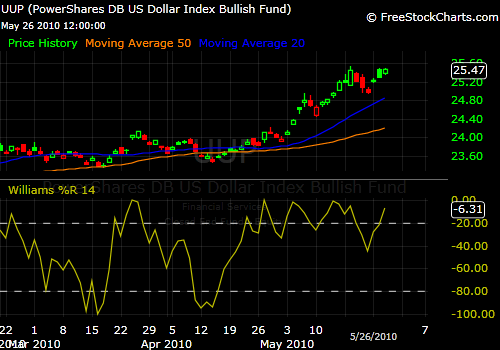

The Chinese apparently have said that they aren’t reviewing their Eurobond holdings so the markets are rocking..this is same scenario that played out with the dollar a few months ago…the US$ is now a pillar of strength, the epitome of fiscal and moral rectitude..

This morning the GDP for q1 has been revised down to 3% from 3.2 when an increase to 3.4% was expected. Jobless claims is better than last week and it, too, is worse than expected. Futures are still holding up.

Data is going back and up…those above not so good..Yesterday, new home sales for April were up 14% over March and 18% year over year. Mortgage apps were up, 30 year mortgage rates down to 4.8%. Durable goods orders were up 2.9%, but ex-trans, declined 1%.

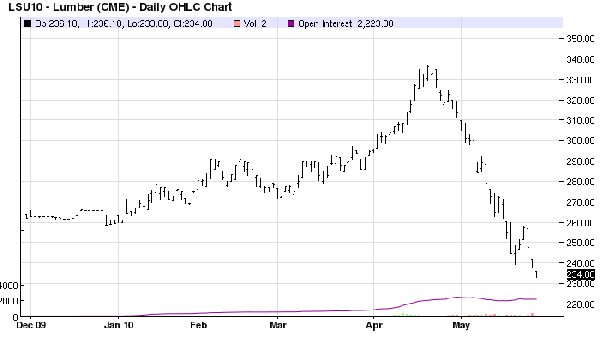

Despite new home sales being down, Lumber futures were limit down for the second day in a row. Did the expiring buyers credit trigger a rash of sales on new-home sitting vacant? If so, lowers inventory but the economic activity that produced them is already done and lumber is telling us that is the case. Many technicians would consider this chart to be less than bullish. This from barcharts.com

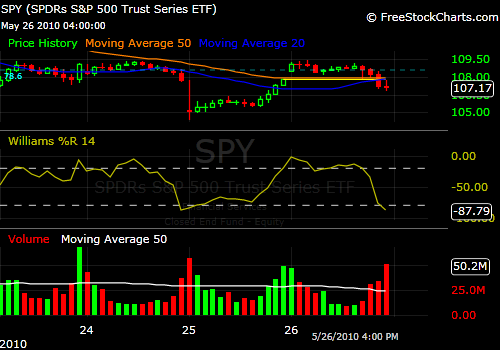

The last couple of days have seen huge intraday reversals. Huge gap down on Tuesday and rose all day, jumped up Wednesday morning and sank like a stone the last two hours on big, big volume. So this mornings gap up is par for the course…will be very interesting to see how the day ends.

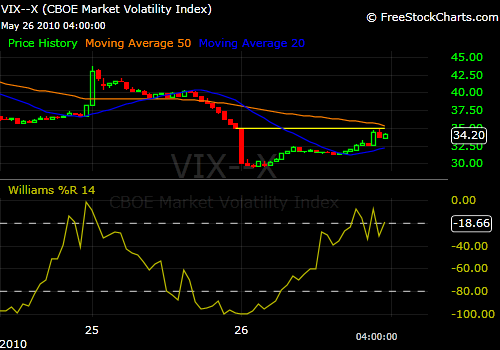

The VIX: this is a 10 minute chart and reflects the market movement

The dollar: our safe-haven in time of trouble-when everyone knows the debt levels on all levels here.

Couple of interesting things…the Baltic Dry Freight index has been rising…the capacity coming on-line to haul iron ore and coal..which is the primary keys to this number..has been growing..so when these prices go up, it means demand for those commodities is rising..China consumes over 40% of iron ore demand. The BDI is up almost 30% since the beginning of May.

The short index declined for the 18th day in row and has an 8 handle at 8.87. Bulls have dropped to 39.9 from 43.8 in the last week and bears have jumped to 29.9 from 24.7.

The TED and the Libor rates are rising.

The first half hour trade contrasted with the last hour trading has been dramatic the last two days and is truly reflective of the dumb money at the open and smart money at the close stereotype. Yesterday, the S&P was up 14.5 points the first ½ hour and sold down 12.4 the final 60 minutes. The contrast in the Dow was plus 105.9 vs. negative 111.4. These trade levels, while not so dramatic on Tuesday, reflected the same variance in the opposite direction. Whipsaw week so far.

Gold index remains number 1 of the 23 IBD measures.

Try to find a safe haven from which to view the tempest until the storm subsides if you can. All those flat people you see embedded in the road and the one that jumped in front of steamroller thinking they could outrun it but didn’t see the one coming from the other direction.

JohnR

Goldensurveyor.com