The recent collapse of the Chinese stock market along with Beijing’s devaluation of the Chinese currency, the yuan, have intensified doubts over the prospects of the world’s second largest economy. Despite unprecedented measures taken by Chinese authorities in the form of hundreds of billions of dollars to support the market, the Shanghai Composite equity index has tumbled by more than 20% in the past week, with a staggering fall of 37% since its peak in June

Chinese factory activity fell to a six-and-a–half year low in August, further substantiating the fact that China is still in the midst of an economic slowdown.

The fall in Chinese stock prices and the country’s economic slowdown have had rippling effects on the world’s major markets. The S&P 500, Dow Jones Industrial average and the Nasdaq plummeted more than 10% since they peaked in May, entering into correction territory. In addition, the European markets declined the most since 2008 and lost more than a trillion dollars in market value.

Considering all the factors above, we believe it is time for U.S. investors to diversify their portfolios to include quality international stocks with Exchange Traded Funds (ETFs) and American Depository Receipts (ADRs) that are less correlated to the other major markets.

Taking a look at India, Indian stocks have been exhibiting contrasting behavior relative to other stock markets for some time now. In fact, the correlation between MSCI emerging markets and MSCI India has been -0.05 for the past year. Furthermore, the correlation of MSCI India with MSCI US has been only -0.11. This negative correlation between Indian stocks and other major global markets provides investors a very good diversification benefit.

While Indian stocks have fallen by 9% this year due partly to the plummeting Chinese equity markets, Indian companies have withstood the slowing global economic environment extremely well compared to other emerging markets. For example, the MSCI emerging markets index has dropped around 27% during the same period.

The slowdown in China has resulted in the collapse of commodity prices, and this slowdown has adversely impacted commodity-exporting countries such as Brazil and Russia. The MSCI Brazil and MSCI Russia are down by 53% and 40% respectively over the last 12 months.

The Chinese meltdown has also affected emerging economies like Korea and Taiwan that are dependent on exports to Chinese consumers. The MSCI Korea and MSCI Taiwan are down by 30% and 22% respectively over the last 12 months. Finally, the depreciation of the yuan has raised doubts on emerging economies who compete with Chinese exports.

Meanwhile, India is heavily dependent on imported commodities, with crude oil accounting for about 34% and gold and silver comprising 12% of the total imports. India imports 80% of its oil, and if the price of oil continues to decline, a fall of one dollar saves the country around $40 billion.

We estimate that if crude oil drops by $10 a barrel, India’s trade deficit will contract by 0.5% and its fiscal deficit will contract by approximately 0.1% of GDP. Hence, falling commodity prices are a blessing for India, resulting in lower inflation and leading to lower interest rates.

Government initiatives like “Make in India” will encourage foreign companies to manufacture their products in India by nurturing innovation, developing skills and providing strong legal intellectual property protection. This initiative is boosting the manufacturing sector and growth of homegrown innovative companies like Flipkart, SnapDeal and Ola Cabs and provides incentives for foreign investors.

Considering these ongoing developments, the consumer confidence has elevated to a new level, and has increased the buying power of Indian consumers. Clearly the growth story of India is a reality.

Japanese brokerage Nomura has projected the Indian GDP Growth at 8% in fiscal-year 2016 while retaining its target for the Sensex at 33,500 by December.

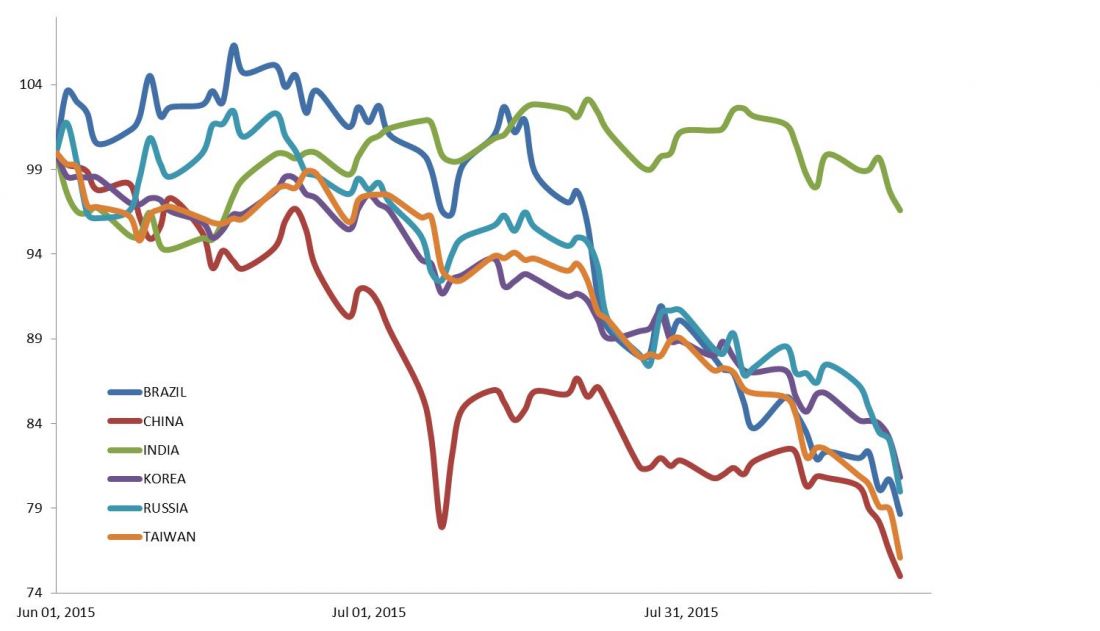

Figure 1: Indian Stocks Have outperformed all Major Emerging Markets this Summer

Source: MSCI Country Indices

The head of the Indian central bank, Governor Raghuram Rajan, has stated that with currency reserves of over $380 billion, India is well equipped to support the value of the country’s currency, the rupee. The fall in commodity prices, especially oil, has helped India get inflation down to 3.78% from the crippling double digit inflation levels in 2013.

Investors who would like to participate in India’s exponential growth might consider: iShares MSCI India ETF (INDA) which tracks MSCI India Index; Market Vectors India Small-Cap ETF (SCIF) which tracks the most liquid small-cap stocks; and Wisdom Tree India Earnings Fund (EPI) which tracks the stocks of profitable Indian companies.

In conclusion, the Indian economy has showcased its strength and resilience to face the global economic weakness with its strong contrasting behavior during the Chinese market meltdown. India, with its high GDP growth, assuring macroeconomic factors, and billion-plus consumers, can provide the world an economic strength that is well-equipped to not only surpass China’s GDP growth but also boost the global economy.

Meghana Gaikwad is the Head of Investment Banking, India at CB Capital Partners, a global financial advisory and investment firm headquartered in Newport Beach, Calif.