The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John

Today’s Golden Sunrise

Tuesday, May 11, 2010

Hours of daily research consolidated for you

Do you wonder if it’s a one-hit wonder?

Two of the greatest one-hit wonders of all-time were “Rescue Me” by Fontella Bass and “I will Survive” by Gloria Gaynor.

Both seem like they could be the theme song for investors these days. The European Bankers, remembering Fontella, came to the rescue with a near trillion package and the markets skyrocketed in rotation-Asia, Europe, and the United States. Plus 400 on the Dow, the CAC was up in the teens percentage wise.

But volume wasn’t that great. The market gapped up dramatically on monster volume…bigger in the first 30 minutes than Friday’s crushing downside…but that was it.. volume faded and the market didn’t move much. Open interest in the S&P, the Dow and the NASDAQ declined on the futures markets.

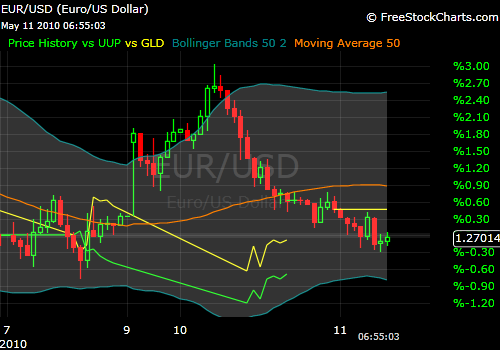

Here’s the playout in the Euro since the rescue package was announced late Sunday before the Asian markets opened on their Monday morning. Gold in gold, US dollar in green lines

Asia was down sharply last night-Europe and US futures are negative this morning as well. Gold is UP, spiking $13 bucks to $1215.90. Confidence in the Euro is already over.

Checking the scoreboards around the world as I always do, Australia had a rough night and the resource stocks there were hammered. They are also in the process of being hammered on the FTSE-except one-Randgold which is up 2.42%, a rather stark contrast to the rest of the board.

The accumulation/distribution ratings on IBD showed another decline of 35 companies in the A category, dropping that key measurement to 166. The A rated companies are the ones we are supposed to be buying along with the big institutions. There were 1004 As on April 16th. That would give a hint the real players were selling into the low-volume rise and selling on the rebounds.

The stocks up list of key stocks that are supposed to be our focus (and deserve to be so), had this nifty 50 composed of stocks with a rating no lower than 98 today..99 is the top of the heap-so the buying, such as it was, was in the leaders.. but, and this was unusual, there was only one (1) new high and that was a gold stock

On a day when all 197 IBD groups were positive-all went up- 197 groups all advanced-this is at least a gray swan-gold ranked in the bottom 10 (underlined in the listings to make it easy to spot the underachievers) and dropped 20 spots to 134 of 197. It was up 2.2% on the day-a level which usually makes the TOP 10. The worst group was up 1.1%. Rare events are not the things markets as based on and I wouldn’t be holding my breath until a day like this comes along again.

As an index Gold held the number 1 spot of 23 which is based on performance over the last 3 months.

The open interest in gold futures increased 8698 contracts to 570,927, which if it is not, is near an all-time high. There is a short on the opposite side of every contract so as many people are expecting a decline as there are bulls but open interest has been rising, contract volume has been rising and price has been rising and that generally means more upside ahead.

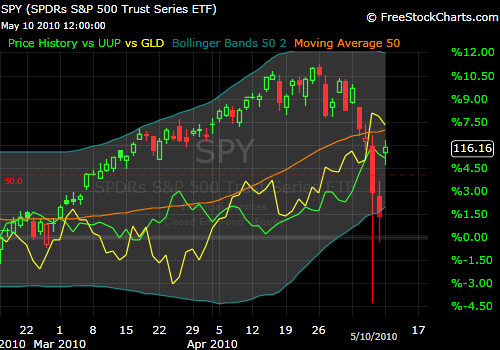

Here is the SPY in the same format as the Euro above with gold (gld etf) and the dollar (UUP). The short-time outperformance of stocks over gold may revert back to long-term trend of the last 10 years.

Most of the bars have been bigger and bigger, meaning wider ranges in the trading day but breaking the 50 dma to the downside in the VP Biden deal and will serve as resistance to resumption of the uptrend.

I am not recommending you do anything..those are your decisions.. and I know the choice of charts and the order I place them make a statement inference and influence. Gold has been moving in the direction of the markets with the reflation trade. There might be a change happening right now-might not-but might. Worth watching.

Same format: GDX (gold stocks)

So are buying gdx and spy? The juniors are below…yesterday up 4%

If you decide the Rescue Me isn’t your favorite tune and it is a one-hit wonder, then I will Survive better move to Number 1 on your hit parade.

JohnR

Goldensurveyor.com