This blog was begun in February 2009. From the very beginning, I have been a “weak dollar” person, believing that the longer-term trend in the value of the dollar is downwards.

My reasoning for this is that the underlying economic philosophy of the United States government has generally been one of credit inflation in order to achieve rapid economic growth and low rates of unemployment and that this has been the case since 1961. And, my belief is that this economic philosophy has permeated both political parties, Republican and Democrat, so that the blame lies with “us” and not with a specific political party.

A consequence of this has been an 85 percent deterioration in the purchasing power of the dollar over this fifty-year period.

And, over this fifty-year period, the value of the dollar has declined by 35 percent against the currencies of major trading partners and more than 35 percent against many other currencies.

Many readers of this blog continue to argue that a decline in the value of the dollar is good because it helps the United States to achieve a lower balance of payments deficit since a decline in the value of the dollar will help us export more goods to other countries and will help reduce imports into the United States.

Floyd Norris has given us an article in the New York Times, “Euro Benefits Germany More Than Others in Zone,” that is important for us to consider. (http://www.nytimes.com/2011/04/23/business/global/23charts.html?_r=1&ref=business) In this article, Norris discusses how Germany has gained in “competitiveness” relative to other eurozone countries since the creation of the Euro. The point of the article is that as Germany gained in competitiveness, it’s balance of payments went from a deficit in 1999 to a surplus by 2002, with the surplus growing from there. Other eurozone nations have experienced just the opposite movement.

The competitiveness of a nation “is based on currency movements and changes in unit labor costs in major industrialized countries” Norris writes.

“German competitiveness against the rest of the world was probably helped by the fact that the relatively poor performance of other members of the eurozone held down the appreciation of the euro against other countries.”

Because of this, the other countries in the eurozone “lost competitiveness because unit labor costs have risen more rapidly in those countries. Absent the euro, many of the countries probably would have devalued their national currencies, but that is not possible as long as they remain in the eurozone.”

In effect, credit inflation plagued the other nations in the eurozone while Germany maintained its fiscal discipline keeping a constraint on unit labor costs.

Due to the loss of competitiveness, the balance of payments in these other countries either turned negative or became more negative.

I believe that the leaders of the United States should learn from this experience. To me, the United States has lost competitiveness relative to the rest of the world over then last fifty years. This loss of competitiveness has resulted in an increase in the balance of payments deficit carried by the United States, in spite of the falling value of the United States dollar.

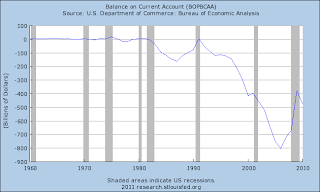

Thus, since the dollar was floated in 1971, the value of the dollar against major currencies has declined by 35 percent. But, the United States lost the surplus it had in its balance of payments and moved into a deficit position in the early1980s. It was almost balanced around 1991 but then the deficit grew throughout the rest of the 1990s reaching its lowest point around 2007. Throughout this time, the declining value of the dollar did not seem to help correct the movement of the balance of payments into deficit territory.

And, I continue to believe that nothing has changed on the economic front. Both political parties in the United States continue to work out of the same playbook…regardless of all the rhetoric.

By focusing just on economic growth and low unemployment, the United States has worked its way into a very uncomfortable situation domestically, internationally, and with respect to the responsibilities it assumed in providing the world’s reserve currency.