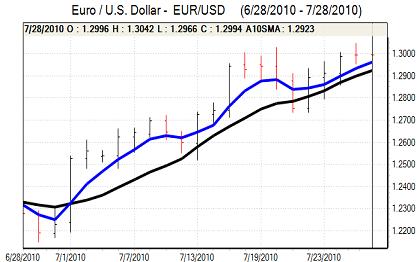

EUR/USD

There was still underlying support for the Euro on Wednesday and it nudged above the 1.30 level in Asia as dollar demand was still subdued.

There were no significant Euro-zone economic developments during the day. The ECB did report that there had been a further tightening of credit conditions during the second quarter and this will raise some doubts over the financial-sector outlook. Similarly, ratings agency Standard & Poor’s stated that European banks were still vulnerable and this is likely to temper Euro optimism to some extent.

The US durable goods orders data was weaker than expected with a headline 1.0% decline for June while there was an underlying 0.6% fall for the month, although the core capital goods reading recorded a gain which limited any negative impact.

The Fed’s Beige Book was also mixed as some districts reported improved conditions, although the gains were limited and two districts commented that conditions had stalled. Credit conditions remained generally tight while the commercial real-estate market remained weak. The report maintained a sense of doubt over the US economic trends.

Risk conditions were less favourable following the Beige Book with Wall Street nudging lower and the dollar secured some support. There was also further evidence of European central bank Euro selling and the Euro again found it difficult to sustain a move above the 1.30 level even though losses were limited.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There were mixed influences in Asia on Wednesday as unease over the potential for a slowdown in the global economy was offset by optimism over Asian growth prospects. The Australian dollar was weaker following benign consumer inflation data and this curbed carry-trade interest to some extent.

The yen was still unable to make much headway as shorter-term US Treasury yields maintained a firmer tone. The dollar held support above the 87.50 level and challenged resistance near 88 against the yen, although it was unable to make a break above this level.

The dollar remained blocked above 88 later on Wednesday and retreated to lows below 87.50 as confidence towards the global economy remained fragile and equities retreated.

Sterling

Sterling maintained a firm tone in early Europe on Wednesday with a challenge on resistance levels above 1.56 against the dollar.

In testimony to the Treasury Select Committee, Bank of England Governor King did express some concerns over the inflation outlook. King was still cautious over the economic outlook and stated that policy could be tightened or loosened over the next few months. On a short-term view, the Governor suggested that interest rates would not be increased, although it is also clear that there will be divided opinion within the central bank which will maintain potential Sterling volatility.

Sterling edged lower following the comments before quickly regaining support as the underlying mood of economic optimism persisted. On technical grounds, Sterling’s ability to hold above the 200-day moving average was also an important element with a challenge on resistance above 1.5620.

Sterling retreated later in the US session with a dip to the 1.5570 area as Wall Street recorded modest losses. The UK currency hit resistance close to 0.8315 against the Euro, but retained a firm tone.

Swiss franc

The Euro hit resistance close to 1.38 against the Swiss franc on Wednesday and retreated to lows around 1.3725 as the Euro came under some pressure on the crosses. The dollar retreated to 1.0540 against the franc before stabilising around 1.0575 as trends on the crosses cushioned movements.

There was further speculation that the National Bank would diversify its foreign-exchange reserves and there was some support for the franc as the bank sold Euros. The franc will also gain some important defensive support if underlying risk appetite deteriorates.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

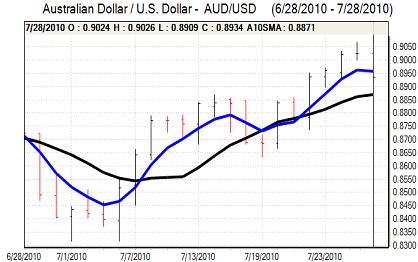

Australian dollar

The Australian dollar weakened further following the weaker than expected inflation data with consumer prices rising 0.6% for the second quarter compared with expectations of a 0.9% advance. There was a retreat to the 0.8950 area against the US dollar as there were reduced expectations of further near-term interest rate increases by the Reserve Bank. In particular, there were reduced expectations of a rate hike next week.

Risk conditions remained important during the day and a generally cautious tone in equity markets triggered an Australian dollar decline to lows close to the 0.89 level in US trading.