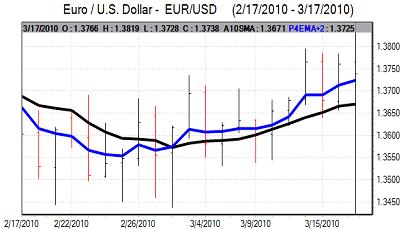

EUR/USD

The dollar was generally weaker during Wednesday and dipped to a six-week low on a trade-weighed basis. The Euro also pushed to a high above 1.38 against the dollar in early Europe, but was unable to sustain the gains and drifted weaker during the day.

German government spokesman Wilhelm stated that no decision had been made on fiscal support for Greece and there was unease that the EU was looking to give the impression of verbal support without actually making any finance available.

US producer prices fell 0.6% for February with a core increase of 0.1% which was slightly weaker than expected and this will tend to lessen any immediate inflation fears which will also continue to dampen pressure for a tighter monetary policy.

The relatively dovish Fed stance from Tuesday will also continue to curb expectations of higher interest rates during the first half of 2010. US Treasury yield spreads over German bonds have still widened very slightly in the dollar’s favour, holding above 50 basis points and this should provide important protection for the US currency and the Euro dipped back to below 1.3750 after a second attempt at breaking above 1.38 failed.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan held interest rates at 0.1% following the latest policy meeting. The central bank also announced that it would expand the 3-month funding facility to JPY20trn in an attempt to keep long-term interest rates down. The easing had been expected which limited any yen selling, especially as there were two members who dissented against the decision.

The dollar weakened back to test support in the 90 area before pushing back above 90.50 in early Europe.

There has been additional speculation that the yen will be used as a carry trade over the next few months and the potential for yen selling will also tend to increase if there is greater optimism over the global economy. Nevertheless, the Japanese currency has still been able to resist heavy selling pressure with a lack of enthusiasm for other major currencies contributing to its resilience and it consolidated around 90.25.

Sterling

Sterling maintained a position above 1.52 against the dollar in early Europe on Wednesday and also held steady against the Euro.

The UK unemployment data was stronger than expected with a 32,300 decline in the claimant count for February after a downwardly-revised increase of just over 5,000 the previous month. The underlying data was less favourable as there was still a decline in employment while longer-term unemployment also increased, but the data still triggered sharp gains for Sterling.

The Bank of England minutes recorded a 9-0 vote for leaving interest rates and quantitative easing on hold which was also in line with market expectations.

The latest government borrowing data will be released on Thursday and a lower than expected borrowing requirement would provide some degree of Sterling support. Underlying sentiment will still be very fragile and political tensions will also be an important factor for the UK currency. Sterling peaked around 1.5380 against the dollar and found support below 1.53 during New York trading.

Swiss franc

The dollar dipped to lows near 1.05 against the franc on Wednesday and was able to secure only limited relief during the day. The Swiss currency maintained a robust tone against the Euro with the Euro weakening to below the 1.45 support level for the first time in 17 months.

Again, there was no evidence of National Bank intervention during the day which continued to encourage selling pressure on the Euro and the bank will remain under pressure to act. The franc has also proved generally resilient even though international risk appetite has been generally robust.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

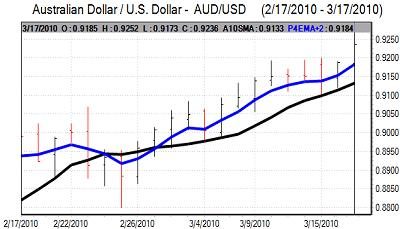

Australian dollar

The Australian dollar found support below the 0.9180 against the US currency during Wednesday and pushed to highs around 0.9250 in US trading. Risk appetite remained generally firm which provided support for the Australian currency.

Confidence in the economy and currency is likely to remain generally firm in the short term, especially if commodity prices remain high. There will still be some degree of caution given the potential for further Chinese monetary policy tightening.